Employer healthcare spending is projected to jump nearly 8% in 2025—the largest year-over-year projection increase in more than a decade—according to a survey released this week by Business Group on Health.

Pharmacy and prescription drug spending plus inflation across all healthcare sectors, from hospital stays to cancer treatment, are the biggest drivers of the 7.8% expected increase in spending, according to the nonprofit organization representing large employers, which has studied healthcare costs for about 50 years.

Specifically, the rising demand for expensive GLP-1 weight loss drugs, cell and gene therapies run through pharmacists, and pharmaceutical cancer treatments are fueling the fast-rising pharmacy costs, according to the group’s 2025 Employer Health Care Strategy Survey, with insights from 125 large employers across industries and representing 17.1 million employees in the U.S.

Overall, although the 2025 projected increase is only slightly larger than the 7.2% forecast for 2024, it is significantly higher than the roughly 6% increase forecast for many years since 2010. Compounded, the projections mean employers are expected to spend 50% more on employee healthcare in 2025 than they did in 2017, the report shows.

“What stands out this year is that healthcare cost is consistently the top priority and source of concern throughout the entire survey,” Brenna Shebel, vice president of Business Group on Health, said during a news conference to announce the survey’s findings. Despite these concerns, she added, 99% of employers plan to continue offering robust health and wellbeing benefits programs next year.

Indeed, employers remain focused on providing affordable healthcare to help employees achieve financial wellness, said Ellen Kelsay, president and CEO of Business Group on Health. This effort also comes as employers continue to face a steady stream of labor challenges and look for tools to boost retention.

Healthcare spending driving employer costs

Most employers, however, plan to cover the added cost rather than pass it along to employees, said Kelsay. “It is being absorbed by employers via plan premiums and contributions to employee health accounts,” she said.

“This is the third year in a row that most employers have opted to absorb these increased healthcare costs in an effort to really address affordability as much as possible for employees and their covered dependents,” she added. “How long employers can continue to shield their employees from some of these cost increases will be telling.”

Pharmacy expenses

The rising pharmacy costs, which include prescription drugs administered at home or medical facilities, are also eating up a larger share of healthcare spending overall. In 2021, for example, pharmacy costs accounted for 21% of the median healthcare spend. Two years later, they accounted for 27%, the report shows.

“That is staggering,” Kelsay said. “This essentially suggests that virtually all of the healthcare trend increase is coming from pharmacy costs.”

She named GLP-1 drugs, which are prescribed to treat diabetes, obesity and cardiovascular disease, as “one of the main characters in that story,” along with the high cost of cell and gene therapies used to treat a variety of conditions.

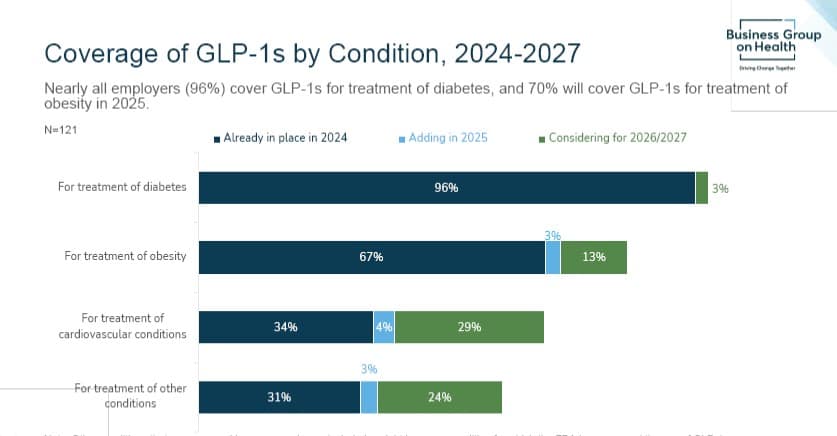

About a third (67%) of employers, for example, covered the use of GLP-1 for obesity treatment this year, up from about half (49%) in 2022. That number is expected to hit 70% next year and spike to 83% by 2027, the report shows. Similar rapid growth is expected for the drug’s use to treat cardiovascular disease, from 34% of employers allowing it this year to 67% by 2027.

Cancer treatments

Cancer ranks as the most expensive condition to treat for the third consecutive year row, according to the survey. It remains ahead of musculoskeletal conditions, such as arthritis and back pain, and cardiovascular conditions, such as arrhythmia, as the three most costly ailments for employers to cover.

Many employers are enhancing their cancer prevention efforts with early screenings to help combat this expense. The study found that 87% of large employers will have at least one cancer screening measure in place next year, up from 77% in 2023. Colonoscopy screenings top the list with 41% of employers planning to offer them, followed by breast cancer screenings at 25% of employers.

Next year, the survey found, some employers plan to increase coverage of cancer screenings and support. For example, 21% of employers plan to offer skin cancer screening, up from 17% in 2024. And 16% plan to offer personalized cancer screening support and navigation, up from 10% in 2024.

In addition to the advanced screenings, employers are deploying many other strategies to address cancer treatment, such as centers of excellence, immunotherapies and other considerations such as genetic and biomarker testing, Kelsay says.

“Cancer costs have long been top of mind for employers,” Kelsay says. “Very costly medical and pharmacy treatments are associated with cancer care.”

Learn more about employee benefits at the upcoming HR Technology Conference & Exposition at the Mandalay Bay Resort & Casino in Las Vegas, Sept. 24-26. Related sessions include Transforming Employee Benefits Technology: Unleash the Power of AI, Analytics and Centralization; Unlock the Power of Your Benefits Ecosystem; and Overcoming Overwhelm: Breaking Down the Barriers to Benefit Utilization. Register here.

The post 15-year high? Employer healthcare spending forecast to soar in year ahead appeared first on HR Executive.