Given how seemingly everything has changed during the past two-plus years of the pandemic, it can be difficult to find things that haven’t shifted. Sara Vidoni, vice president of product solutions at Businessolver, however, has noticed one piece of data: how much employees say they know and understand benefits.

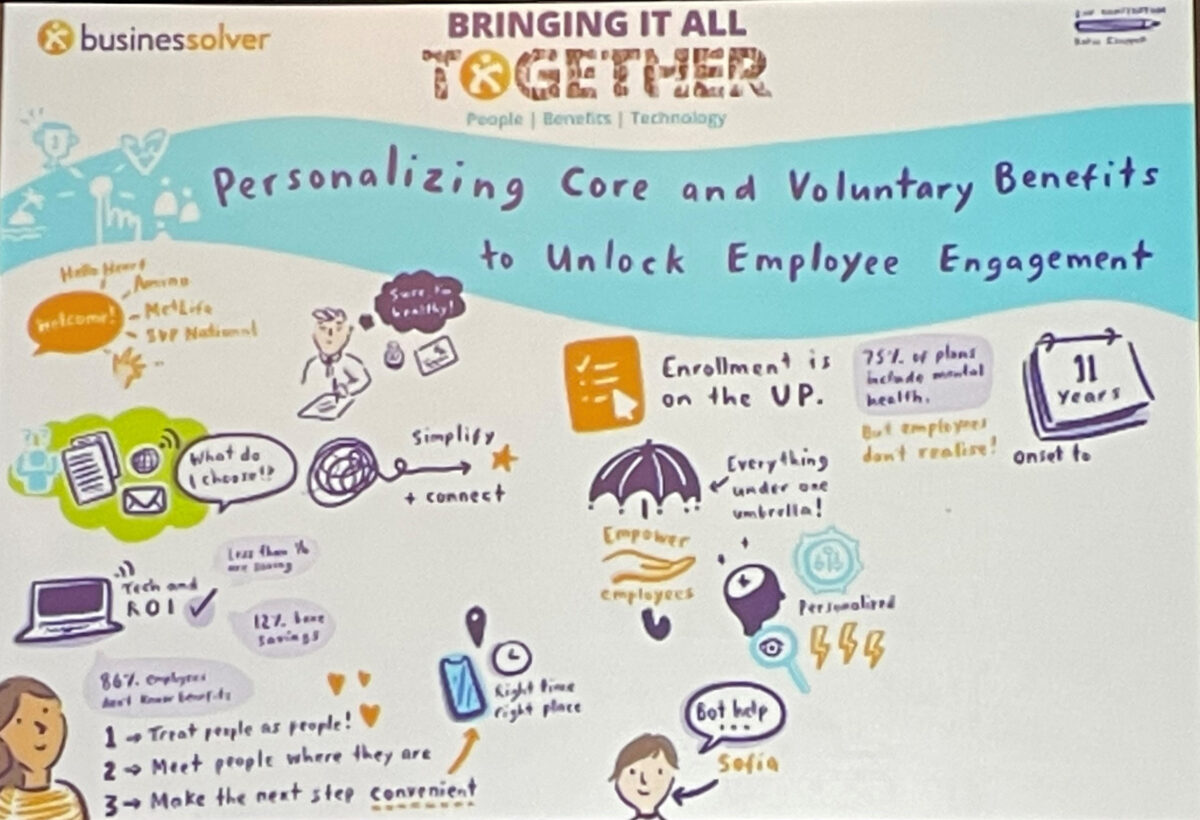

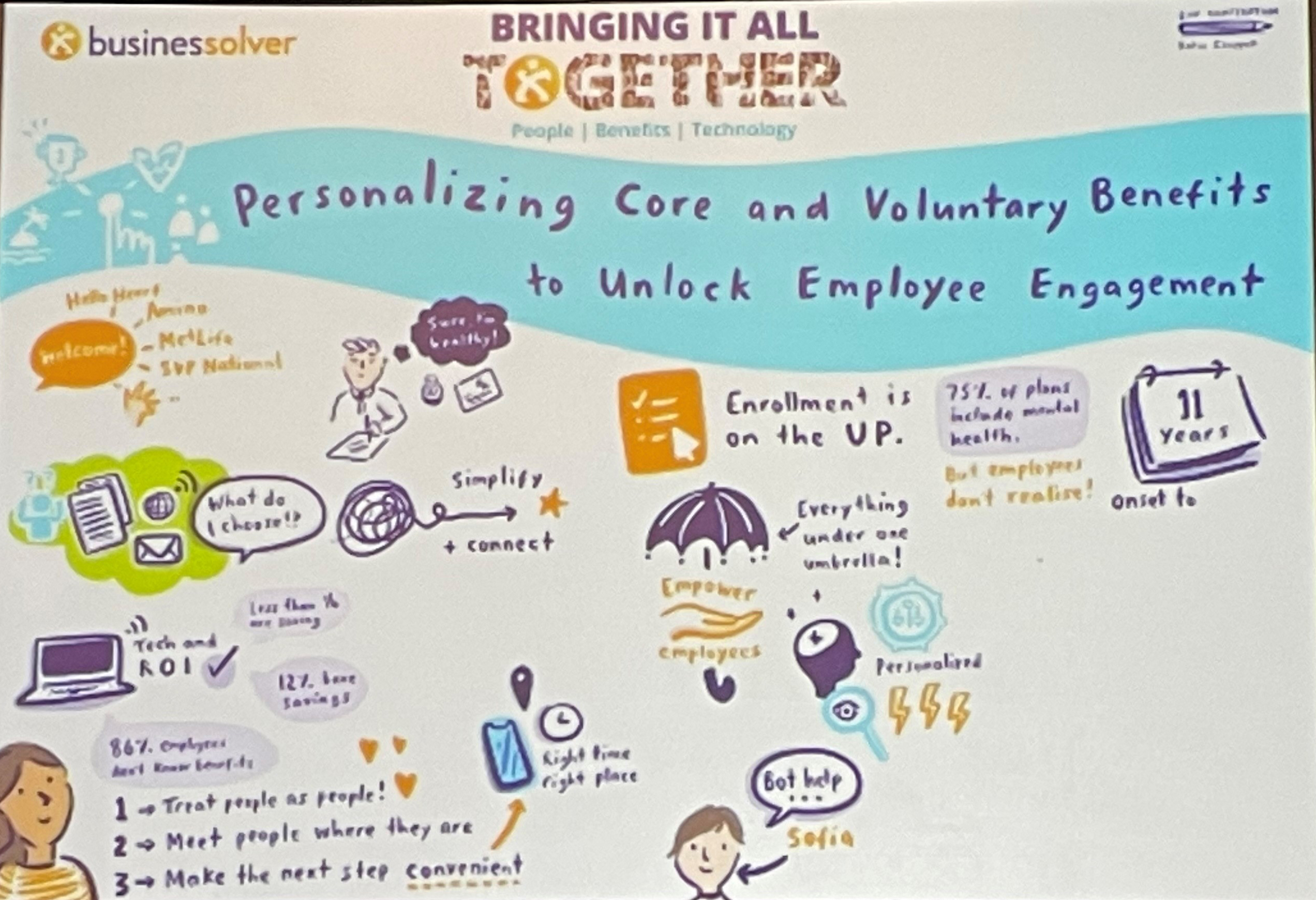

“Eighty-six percent say they ‘don’t know benefits,’” Vidoni said in setting up a discussion during a break-out session Tuesday at the Health & Benefits Leadership Conference titled “Bringing it All Together: Personalizing Core and Voluntary Benefits to Unlock Employee Engagement.” “And that’s been the case for more than 20 years.

“So, how do we start to move the needle on that? What do we need to be doing from a technology perspective to try to drive a better impact?”

HR leaders need to make better use of the data they collect on employees’ health and healthcare. They need to improve connections between and among their various solutions and benefits offerings. And they need to boost storytelling to help employees know and understand and engage with their benefits—both to reduce organizational costs and to increase employee wellbeing.

Related: Weathering the storm: Ginger Zee talks mental health in the workplace

Those were some of the takeaways from Vidoni and her panelists: Jenn Roberts, vice president of employer health strategy for Hello Heart, a hypertension-focused solution; Missy Plohr-Memming, senior vice president for national account sales at MetLife; and Andrew Rosenthal, chief product officer at Amino, a healthcare guidance platform.

Much of it starts, Rosenthal argues, with creating an employee experience that accepts digital solutions as a foundation. He suggests focusing on three things with EX:

- Treating people as people, not ID numbers or profiles.

- Meeting people where they are on the health journey.

- Making the right choice convenient.

And once you’ve created that EX, it’s about using data to drive engagement, he said. “Digital is table-stakes. What you do with it is the opportunity in 2022.”

Plohr-Memming leaned into the notion of meeting people where they are with the story of her son, a surgeon who needed to choose his own benefits about two years ago. He was baffled, despite a mother who has spent most of her then nearly 30 years at MetLife working in benefits, a high level of education and familiarity with the healthcare system.

Plohr-Memming leaned into the notion of meeting people where they are with the story of her son, a surgeon who needed to choose his own benefits about two years ago. He was baffled, despite a mother who has spent most of her then nearly 30 years at MetLife working in benefits, a high level of education and familiarity with the healthcare system.

“We don’t make this easy,” she said, emphasizing how the message hit hard when her son was sitting in her house with a pile of “ugly paper” and no storyline to help connect his benefits to each other and his needs.

“We’re trying to meet people where they are, which means you have to have an omnichannel approach,” she said, including paper, text, website, apps, bots and actual people.

As for connection, Roberts noted that 47% of people in the United States currently have hypertension, something that is so concerning to the Centers for Disease Control and Prevention that it recently called on employers to help workers get this issue under control by putting blood pressure monitors into homes.

That step would empower employees and help personalize their care, something that is key to improving health. Hello Heart, for example, is just one technology that could feed data into an employer’s system and, with employee consent, be used to generate possible savings on insurance or other actions to help boost engagement and, ultimately, health.

“We’ve seen so many solutions become available in the last two to three years and they’re all great; they all have an incredible impact that they can make for you, Vidoni said. “But if we don’t create the right journey for the employee through those technology experiences, it’s all for nothing: You’re investing in all these programs and you’re not going to be able to put them to use. You’re investing in voluntary benefits and your employees aren’t using them at the end of the day.”

The post How to get employees to engage with benefits using tech appeared first on HR Executive.