Small businesses have to manage all sorts of accounting tasks ranging from managing their finances to inventory control. Between keeping track of a company’s bills, invoicing contractors and customers, reconciling bank statements, controlling spending, overseeing projects and staying on top of tax compliance, what’s a small business owner to do?

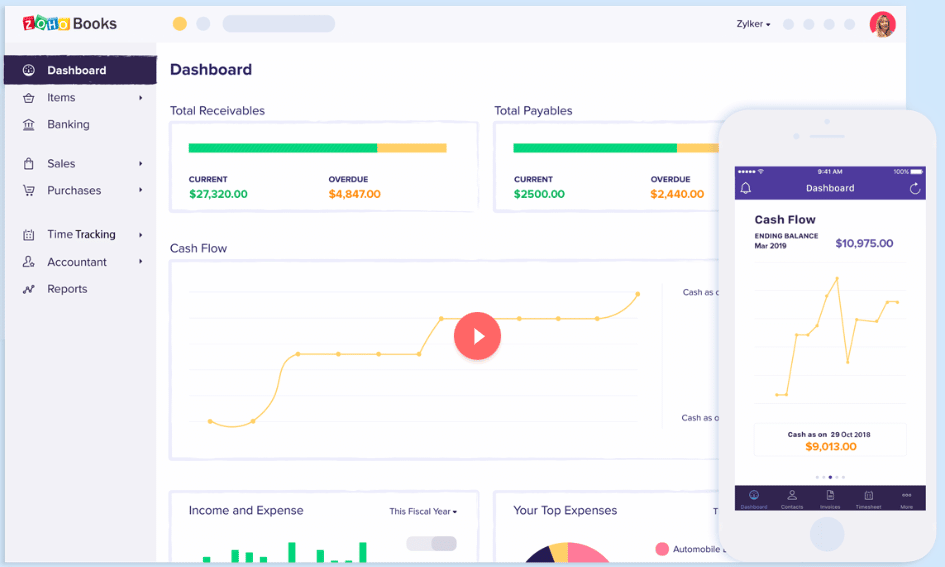

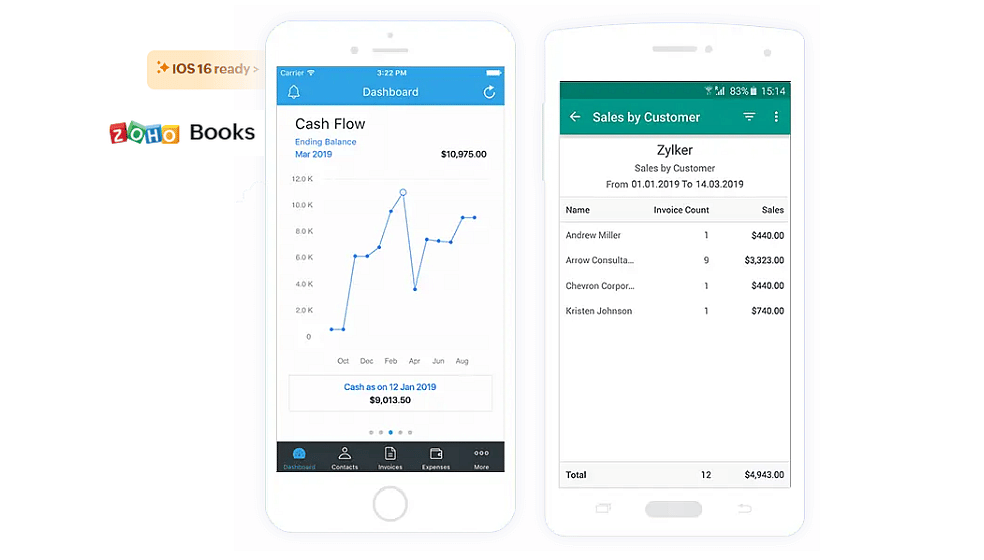

Fortunately, online accounting software can help small business owners manage their finances, automate business workflows and work collectively across departments. While there are a variety of accounting software choices, many business owners prefer Zoho Books to provide end-to-end accounting solutions, easy collaboration opportunities and an integrated platform.

What Is Zoho Books?

Zoho Books is a completely cloud-based, double-entry, multi-user accounting application. Launched in 2011, it is part of the integrated Zoho ecosystem consisting of a plethora of popular business software options. Its powerful platform capabilities and focus on privacy make it a top choice among business owners who want to keep up with ever-changing business trends, taxes and cloud implementations.

What are some of its most popular features? Users can complete all of their accounting tasks with ease, including:

- Payables – Books makes managing payables easy by helping users create and send purchase orders, upload expense receipts and track payments issued.

- Receivables – Business owners can get paid on time. The software helps them create invoices in seconds, chase payments with payment reminders and get paid faster by offering customers an online payment option.

- Inventory – Users are better able to manage their inventories since the software help them keep track of their inventory levels, set reorder points to replenish stock when it’s low and organize their inventories with vital information like SKU, cost and stock on hand.

- Banking – Want an accounting application that also manages your banking? Books can help you set up your bank account and import transactions to your accounting software, skipping the data entry. It also allows users to create rules that categorize banking transactions, reconcile transactions and stay prepared for tax season.

- Time Tracking – The online accounting software helps users keep track of time spent on projects and invoice their customers. With Zoho Books, users easily can manage multiple projects, create invoices directly from their projects and track unbilled hours and expenses.

- Contacts – Want to have all your contacts in one place for easy communication? You can create, edit and manage your customers and supplier contacts from within, collaborate with clients through the client portal and securely store customers’ payment information to automatically charge them for recurring transactions.

- Reports – Books offers more than 50 business reports, including profit and loss statements, inventory summary reports and tax summary reports. Businesses using Zoho Books run smoothly because they can schedule and share reports, access business overviews with their custom dashboards and customize reports with filtered data for improved insights.

Customizations

Of course, Zoho Books provides end-to-end accounting functionalities, but it also offers additional out-of-the-box accounting applications, advanced analytics within the software, advanced inventory control and much more. Customization is one of its most important capabilities.

“The product itself was designed with the idea in mind that we should never restrict the user flow,” says senior accountant development manager Dheeraj VN. “We wanted our users to define the flow in which they want the application to work, which is why it’s highly customizable.”

Some of the customization options that have been added to the application include open API, which allows users to connect third-party applications, as well as their websites and other Zoho applications.

Trusted Tax Experts Around the World

It is also designed to support scalability. Users’ businesses are not limited by geography since the application is available in multiple editions to comply with tax laws in 14 countries, including the United States, Canada, Mexico, the United Kingdom, Australia, Kenya, India and more. It is also available in 17 languages.

“We can confidently say to our customers that if you are from one of these 14 countries, then Books is complying to the local regulations in that particular region,” says VN.

Of course, it’s not limited to users in those countries, since Zoho strives to assist with filing taxes elsewhere by generating useful reports.

Integrations

One way that Books stands apart from its competition is through its integration capabilities. Not only is the application integrated within the Zoho finance suite and the expansive Zoho suite of applications, but it also can be integrated with a host of popular third-party business applications.

“Within the Zoho finance suite, Books is the central application, and data from all the other products, including your inventory, your subscription management application, your travel and expense reporting software and payroll, eventually lands in Zoho Books automatically,” VN says. “So, users need not do anything at the end; it’s all pre-integrated. That’s the advantage that our users get.”

Zoho finance integrations with Zoho Books include:

- Zoho Inventory

- Zoho Subscriptions

- Zoho Expense

- Zoho Invoice

- Zoho Checkout

- Zoho Payroll

Zoho Books also integrates with other Zoho applications outside of the finance bundle, including:

- Zoho CRM

- Zoho Analytics

- Zoho Projects

- Zoho People

- Zoho Flow

Zoho Books connects with far more than other Zoho applications, however. It also can be integrated with a variety of third-party applications, including Zapier, Twilio, Slack, Razorpay, EazyPay, PayPal, Office 365, Evernote, SurePayroll and G Suite. Zoho Books even features its own marketplace, where developers or partners are able to build and publish extensions to use for their own businesses or other users.

Zoho Books Business Stories

How do Books customers practically use the application? VN demonstrates how customers can implement Books to its fullest by describing two distinct customer use scenarios, highlighting how the online software can benefit users in retail and service industries.

Use in a Retail Business

Jackson, a retail business owner deals in various items in multiple warehouses spread across Canada. His sales come from online, walk-in and wholesale customers. Jackson is seeking an accounting software solution that will help him sell on multiple online platforms, know the best-performing products and real-time stock information, reconcile financial accounts, manage sales, collaborate with customers and vendors, as well as stay tax compliant.

Jackson was able to optimize his business processes with Zoho Books by using the application to:

- Configure locations and warehouses – Jackson can configure the various locations at which he has warehouses.

- Set up product and price lists – Zoho Books helps Jackson configure his product catalog by importing inventory and customizing price lists.

- Connect bank and credit card accounts – By connecting bank accounts to Zoho Books, every transaction will automatically appear in Zoho Books for reconciliation.

- Generate reports – Zoho Books features more than 70 dynamic and customizable reports, including business overview reports and inventory reports.

- Collaborate with customers and vendors – Jackson can configure his vendors in Zoho Books in order to manage his purchase process through Zoho Books. He also can utilize the customer portal and vendor portal for enhanced collaboration within Zoho Books.

- Manage sales end-to-end – With Zoho Books, Jackson can create customer profiles and generate invoices, sales orders, estimates and purchase orders from templates, as well as manage online sales and shipments from multiple platforms.

- Comply with applicable tax requirements – Zoho Books helps Jackson ensure his business is tax compliant. The application is designed to support tax compliance in 14 countries, and it generates the necessary reports so users like Jackson can file their taxes directly from Zoho Books and even push the records directly to the appropriate government portal.

Use in a Service Business

Sophia is the CEO of a growing enterprise that provides marketing services to thousands of micro-enterprises across the globe. She is looking for an accounting software product that will support her endeavors to sell globally, empower her sales team with finance data, efficiently track projects rendered, identify the best-performing services and remain tax compliant.

How can Zoho Books help Sophia meet her business goals? She can optimize her business processes by using Zoho Books to:

- Manage sales in multiple currencies – With Books, Sophia can create profiles and manage sales for customers across the globe, invoicing in multiple currencies and in any language.

- Connect to Zoho CRM – Because Zoho offers a connected ecosystem, including Zoho CRM, Sophia can access all her financial data from within the CRM.

- Track client services – Sophia also can use Zoho Books to create projects for tracking services.

- Collect online payments – With Zoho Books, Sophia can accept payments worldwide using inbuilt payment gateways. She also can collect advances from customers.

- Customize invoice templates – Sophia can use Books to customize her choice of numerous invoice templates.

- Create approval processes – It’s simple to create approval processes, such as those for timesheets and transactions, using Zoho Books.

- Automate tasks – Zoho Books saves Sophia time managing her company by allowing her to automate tasks such as payment reminders and late fee collection.

- Gain valuable insights – Thanks to advanced analytics, Zoho Books will generate meaningful reports based on Sophia’s data.

- Remain tax complaint – Like Jackson, Sophia can count on Zoho Books to help her remain tax complaint based on the tax requirements in 14 different countries.

Zoho Books Pricing

How much does Zoho Books cost? The cloud-based accounting software solution is available in a variety of pricing plans to accommodate different business needs and budgets.

The free Zoho Books version is available to businesses with annual revenue less than $50,000. It accommodates one user and one accountant. From there, the standard version of Zoho Books costs $10 a month and supports up to three users, the professional version accommodates up to 5 users for $20 a month and the premium version supports up to 10 users for $30 a month.

Elite and Ultimate versions are also available for $100 and $200 a month. Each subsequent version includes more features than the lower levels.

Image: Zoho

This article, “Zoho Books is a Powerful One-Stop Platform for Managing Accounting Tasks” was first published on Small Business Trends