Securing funding to expand your startup or other venture-funded small business is always a grueling experience, but COVID-19 has piled on the challenge.

The global economy has taken a steep dive, with plummeting sales and soaring unemployment causing stock markets around the world to shrink at a rate unseen since the 1929 depression. The situation is creating extremely unfavorable conditions for all upstart small businesses.

Unsurprisingly, investors are curbing their generosity towards new startups and SMBs, and the confusing buoyancy of the stock market in recent weeks hasn’t greatly reassured investors. The funding landscape has altered rapidly, and great company leaders need to know how to respond to the changed conditions.

The New VC Landscape in 2020

2020 opened to great hopes for business owners. It followed two years of increasing amounts of VC investment, partly thanks to the entrance of new funds. Q1 2020 saw the highest ever level of investment in US startups, with $34.2 billion invested across 2,298 venture deals and another $23 billion in late-stage deals, and it was paralleled by incredibly strong investment in European companies, to the tune of €8.2 billion.

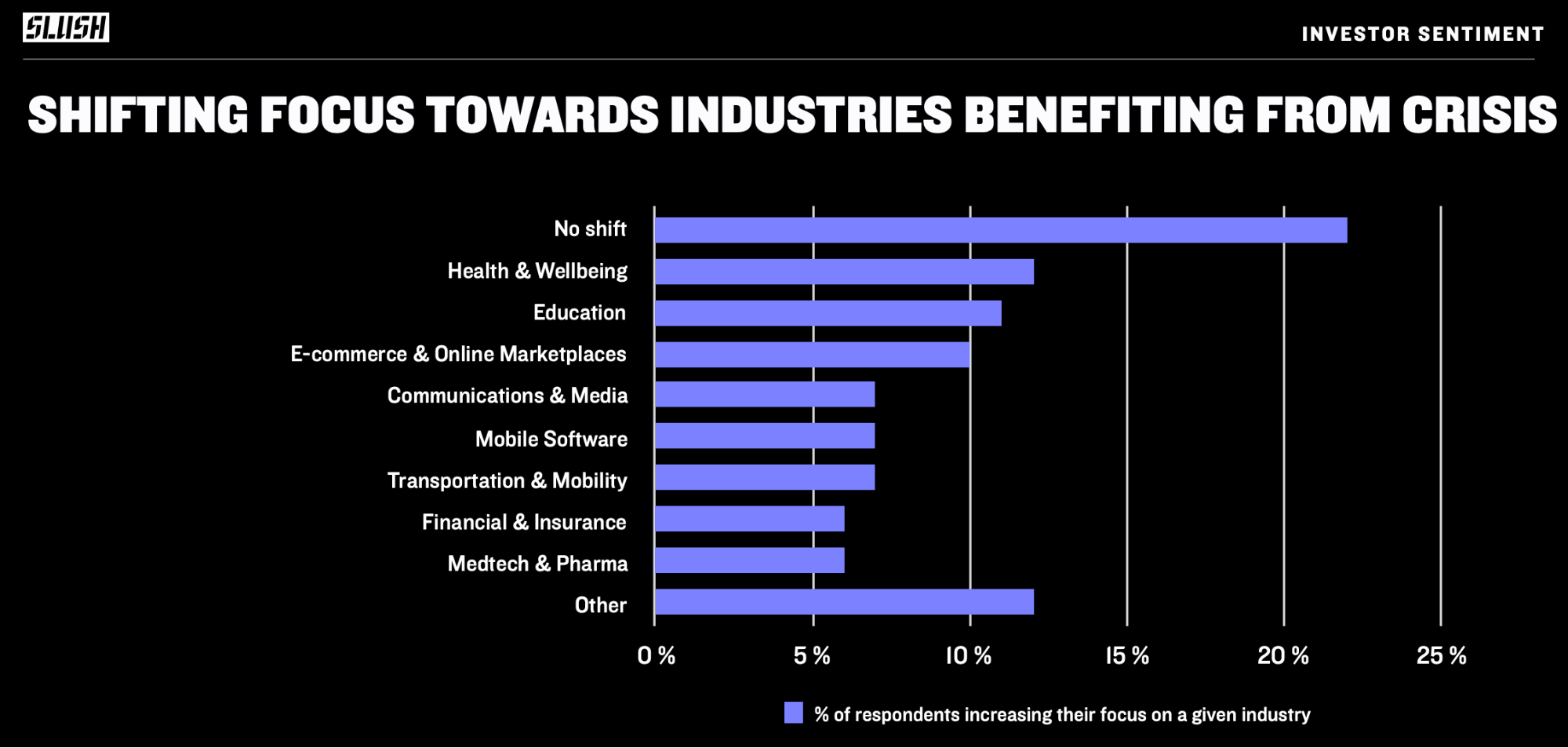

But the sudden appearance of COVID-19 rocked the boat. In a climate of uncertainty, VCs naturally want to focus on their portfolio companies, with 46% shifting to ensure they have sufficient cash flow to weather the storm, according to a survey published by Slush. Fund managers are more nervous than usual about taking on new investments.

On the other hand, it would be a mistake for upstart SMB leaders to think that the funding market has come to a grinding halt. VCs are still looking for new opportunities, often hoping to pick up promising businesses at a lower valuation than previously. There are still investors willing to take a risk on new upstart small businesses, especially in certain sectors such as healthcare and education. In fact, healthcare businesses are still flourishing, with 12% of VCs saying they shifted to invest in health and wellbeing startups, according to Slush’s data.

If you take a long-term view of the last ten to 15 years, it’s clear that investors don’t swear off funding during a downturn. Research from Crunchbase reveals a number of companies that completed Series C, Series B, and even seed rounds during the last recession, and went on to stellar exits. Yet scoring that funding requires a change of play for successful founders.

1. Due Diligence is Coming to the Fore

In an atmosphere of great uncertainty, under increased pressure not to make mistakes, and to compensate for drawbacks of remote pitches, which hamper the ability of investors to “read” founders and build trust, VCs are pouring more energy into due diligence.

Business leaders should expect increased scrutiny of their figures, projections, burn rate, cash runway, impact of coronavirus on sales, and future plans. In the words of one VC partner who spoke anonymously with Business Insider, “Each startup’s financial plans will be scrutinized more closely during fundraising. Founders should be prepared to walk VCs through their startup’s burn rate and cash runway, while explaining how the coronavirus pandemic has affected sales.”

It’s a challenge that business founders can prepare to overcome by:

- Spending even more time preparing appealing, easy-to-consume documents and reports.

- Making all their content instantly shareable and accessible for potential investors by placing them in an extra-secure repository, such as a virtual data room.

- Ensuring that every document is well organized, so that investors can swiftly move through your data without too much effort.

“The current business environment is tough, which serves to underline the importance of having everything in place so you can make bold moves quickly,” writes Markus Mikola, the CEO of ContractZen, a company whose software facilitates corporate governance and secure file sharing. “In these conditions, facing increased competition from globalized markets, the ever-growing speed of business, rising regulations, and the challenge of digitalization, corporate management needs to be ready to react to new opportunities and shifting market forces.”

2. It’s Good to Be a Camel

If the business world used to be all about unicorns, now camels are taking the lead. Unicorns dazzle swiftly, but camels are in it for the long haul. Turning your business into a “camel” company means prioritizing resiliency, commitment, caution, and customer focus above all else. This approach makes you more stable, less dependent on external funding, and more attractive to investors.

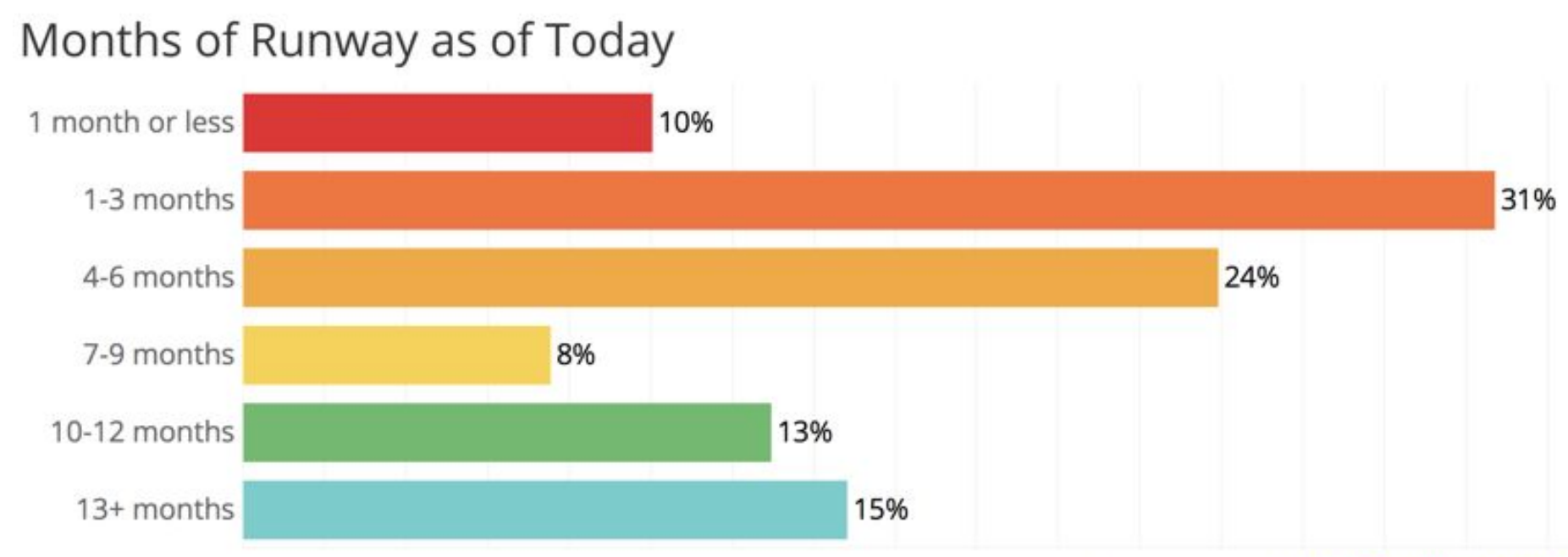

Consider that 50% of the investors polled by Slush think it will take 12 months or more for deal volumes to normalize. For startups and other funded small businesses that live on short runways, a year-long delay on securing further funding could be catastrophic, especially given that 41% of startups are now in the “red zone,” with under three months of working capital, according to Startup Genome’s estimates.

Kareem Aly, principal at Thomvest Ventures cross-stage venture capital fund, advises fellow investors to look for “companies with scrappy teams that can keep their burn rate low while focusing on product and UI/UX,” a clear vote of confidence for camel businesses.

3. Maintain Your Focus on Relationships

Great company leaders focus on relationships in every direction — with customers, employees, and investors — and today that’s more important than ever. Being customer-focused is a key pillar of the “camel” approach. When you can demonstrate that your products are all customer-driven, it increases your ability to demonstrate value to funders.

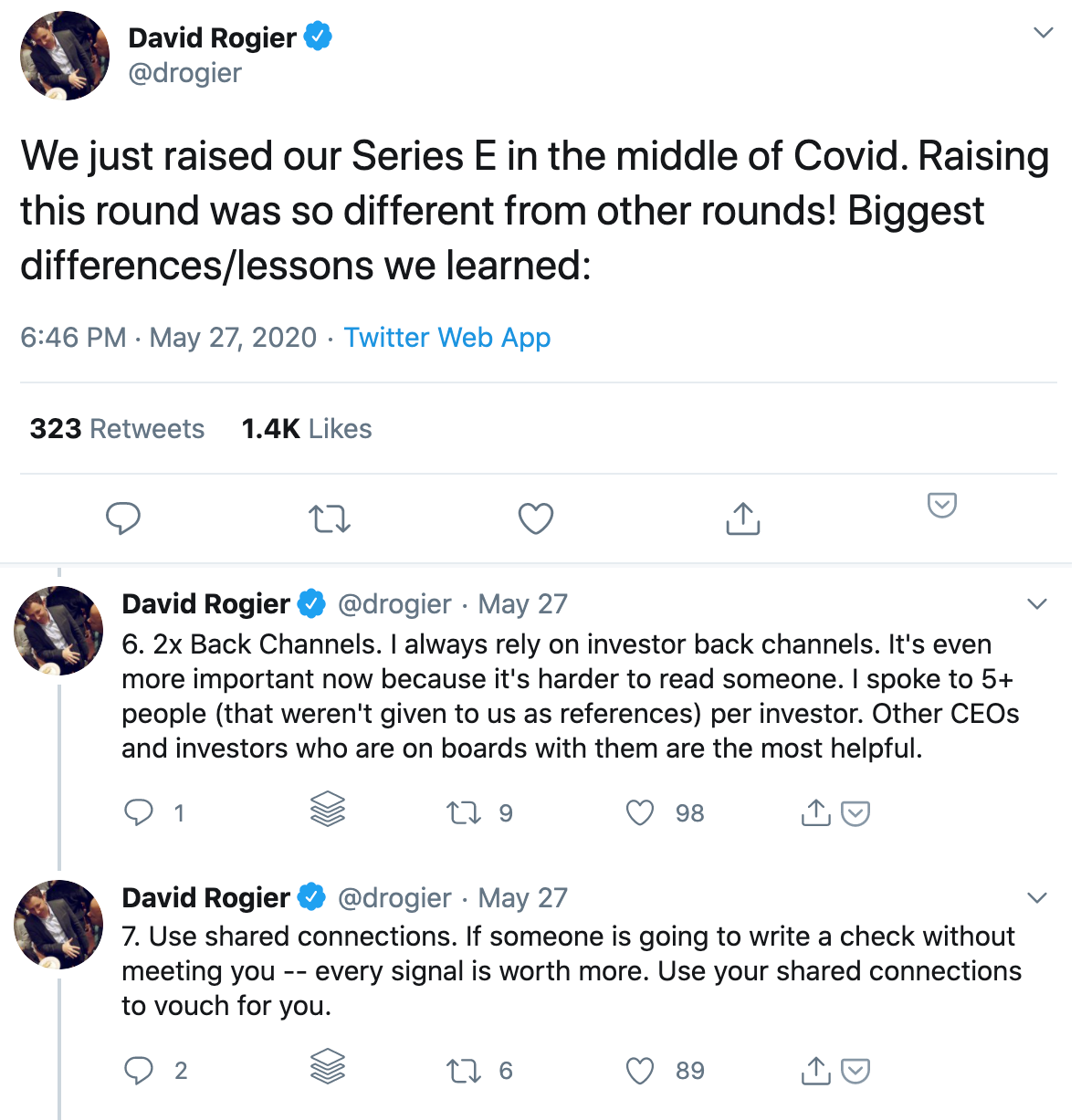

Remote pitches make it harder for investors to build a relationship with new founders, leading many VCs to prefer to invest in businesses led by familiar names. First-time founders are currently struggling more than repeat founders to raise funds, Slush has found. David Rogier, CEO and co-founder of Masterclass, which successfully raised its Series E round during COVID-19, emphasizes the need for strengthening connections and references to score funding.

Now is not necessarily the time for company leaders to rush to cut jobs. Your team is your excellence, so ensure you hire and retain the best talent. Definitely institute a hiring freeze to cut costs, and only institute layoffs if you’re truly in danger of running out of runway.

Funding Is Still There for Those Who Know How to Find It

There’s no denying that the outlook for upstart small businesses is concerning. Many VC funds are shrinking their investment activity to focus on portfolio companies, but funds are still there and investors are still active, holding out the potential of securing vital investment as long as founders pay attention to the way the game has changed.

Business owners and leaders who can shift to think like a camel rather than a unicorn, prize their relationships with investors, team, and customers, and place due diligence at the top of their list, are on the road to success.

Image: Depositphotos.com

This article, “3 Things for SMB Startup Leaders to Consider When Pitching VCs in 2020” was first published on Small Business Trends