Let’s be honest – when it comes to recruiting KPIs, we all want to know how our numbers compare to others. It’s like when someone completes a marathon – you should be thinking, “Wow, that’s an amazing achievement,” but instead, the first question that comes to mind is, “What was your time?”

Recruiting leaders are always curious about what other companies are measuring. Yet, when you attend a conference session on hiring metrics or listen to industry discussions, you’ll often find that many companies struggle to define and measure hiring success effectively.

The Problem with Traditional Hiring Metrics

Most organizations begin with a narrow focus on two key metrics:

- Time-to-hire: How quickly can we fill a position?

- Cost-per-hire: How much does it cost to recruit a new employee?

These KPIs dominate because many companies take a reactive approach to hiring. When a position opens, the immediate priority is to fill it as quickly as possible. However, as businesses mature, their hiring strategies – and the metrics they track – must evolve to focus on quality, efficiency, and long-term impact.

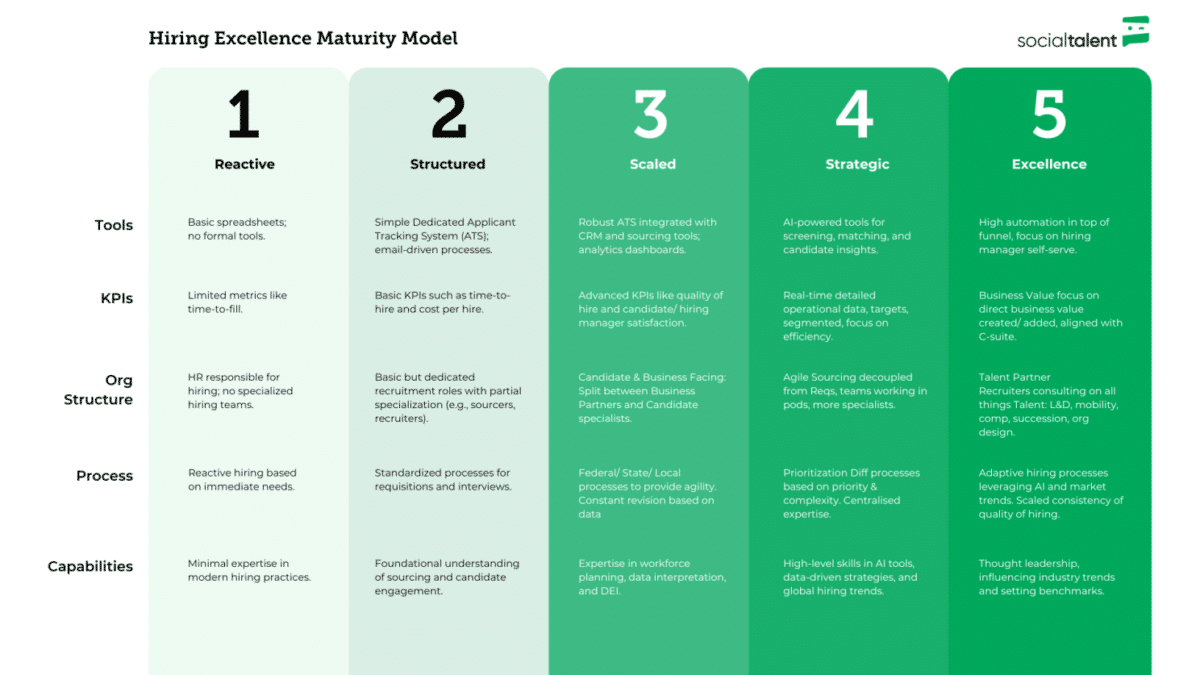

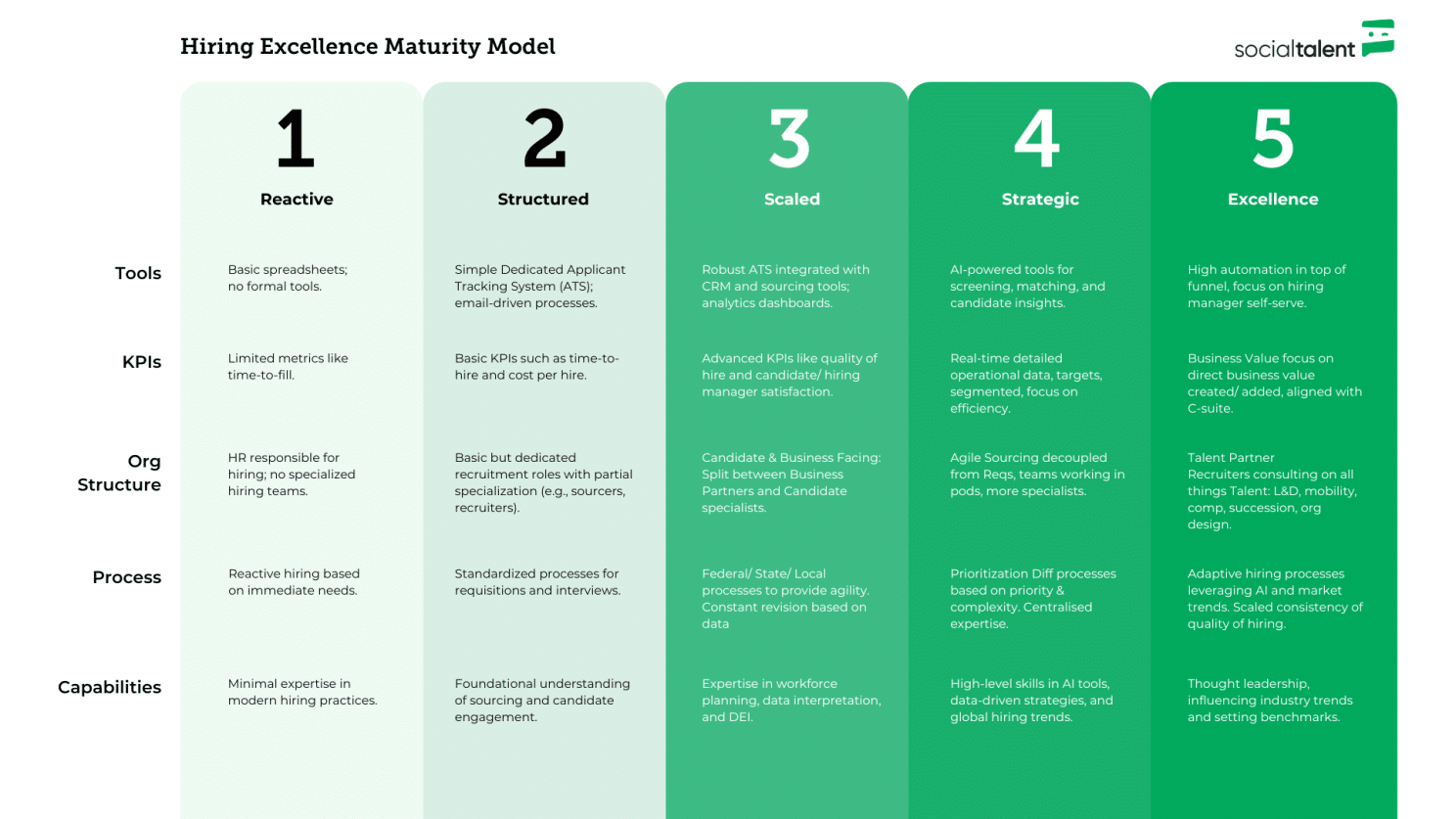

So, how do hiring metrics change as companies progress along the Hiring Excellence Maturity Model? And how can you avoid chasing vanity metrics that don’t align with business success?

Level 1: Reactive Hiring (Speed Above All Else)

At Level 1, recruiting is entirely reactive. Hiring managers just want an open role filled ASAP. The primary KPIs at this stage include:

- Time-to-hire

- Time-to-fill

- Time-to-interview (maybe)

Here, speed is the only indicator of hiring success. However, fast hiring doesn’t necessarily mean effective hiring. If speed is the only goal, companies may experience higher attrition rates and frequent re-hiring cycles, leading to long-term inefficiencies.

Level 2: Cost Optimization (Beyond Just Speed)

As companies grow and start hiring at scale, cost-per-hire becomes a significant KPI. At this stage, leadership begins asking:

- How much are we spending on recruitment?

- Can we reduce our dependency on agencies?

- Where can we cut costs in the hiring process?

Forecasting hiring needs and optimizing for cost-effectiveness become priorities. However, unplanned hiring – due to attrition or sudden business changes – can disrupt even the best-laid plans. At this stage, hiring is still operational rather than strategic.

Level 3: Quality of Hiring Takes Center Stage

At Level 3, companies shift from reactive hiring to proactive talent acquisition. They implement structured hiring processes, proactive sourcing, and align recruiting with business strategy. New KPIs include:

- Candidate experience (NPS surveys)

- Hiring manager satisfaction

- Interview effectiveness (Are we making strong hiring decisions?)

- Conversion rates (How many candidates advance through each stage?)

This stage is where companies begin tracking hiring effectiveness rather than just speed and cost. However, many mistakenly believe they are measuring “quality of hire” when they are actually measuring quality of hiring – the efficiency of the process rather than the long-term success of new hires.

Level 4: Data-Driven Hiring Optimization

At Level 4, companies take a data-driven approach to hiring, breaking down recruitment metrics into deeper layers. New KPIs include:

- Time-to-source: How long does it take to find qualified candidates?

- Time-to-first-interview: Are we moving fast enough early in the process?

- Offer acceptance rates: Are we losing candidates at the final stage?

- Outbound response rates: How effective are our outreach efforts?

Hiring becomes more predictable, and companies optimize for efficiency. However, many organizations get stuck here – over-focusing on process optimization without truly measuring the impact of hiring decisions.

Level 5: Measuring What Really Matters (Quality of Hire & Business Impact)

At Level 5, companies recognize that a faster, cheaper hiring process does not necessarily lead to better hires. The ultimate KPI at this stage is quality of hire, measured by:

- Performance outcomes of new hires: Are they excelling in their roles?

- Retention & promotion rates: Are we keeping and developing top talent?

- Impact on business objectives: Is our hiring strategy driving business growth?

Here, hiring stops being a cost center and becomes a value driver. Instead of just tracking recruitment efficiency, organizations measure how hiring decisions contribute to long-term business success.

Where Does Your Hiring Strategy Stand?

Look at your recruiting KPIs. Are you still primarily measuring time-to-fill? Are you tracking quality, but only within the hiring process? Or are you actually measuring the long-term success of your hires?

The KPIs you focus on will shape your hiring strategy. If you measure only speed, recruiters will prioritize quick hires over quality fits. If cost is the main focus, hiring will become transactional rather than strategic. But if you measure the business impact of hiring, recruiting transforms from an operational process into a competitive advantage.

Many organizations want their recruiters to act as talent advisors, but if you’re only optimizing for speed and cost, you don’t need strategic business partners – you just need transactional recruiters. If you truly believe in talent advisory, you need to shift your hiring focus toward quality and long-term value.

A version of this article originally appeared in Johnny Campbell’s Talent Leadership Insights LinkedIn newsletter. Click here to subscribe!

The post The Evolution of Recruiting KPIs: How to Measure Hiring Success appeared first on SocialTalent.