Since the COVID-19 outbreak, more than 40% of Americans say they use cashless frequently this year. This according to research data analysis by Comprar Acciones for the third quarter of 2020. When it comes to GenX the decrease in cash usage is down by 53% and it goes up to 64% for those with incomes higher than 150K.

Hardly surprising since more people are trying to limit their point of contact. For small businesses, this means implementing contactless payment solutions along with curbside and delivery services as part of their operations.

Finding the right balance of safety and convenience is key to keep customers happy and coming back. But the one constant is, the adoption rate of contactless payments is increasing.

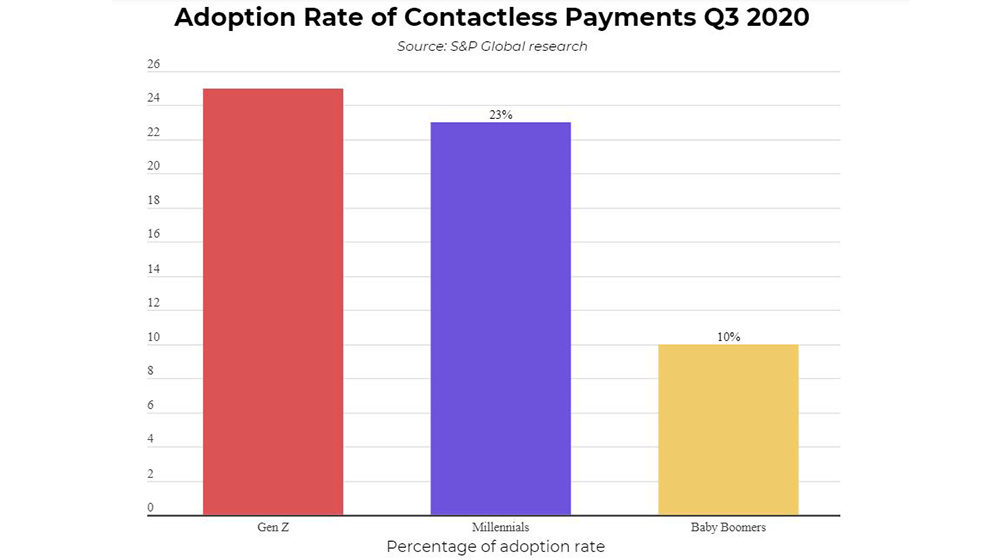

Adoption Rate of Contactless Payments

In the report, more than one in six of the respondents said they made their first contactless payment after the pandemic started.

The highest adoption rate comes courtesy of Gen Z at 25% with millennials following at 23%. On the other hand, baby boomers came in at 10% with the lowest adoption rate. As far as existing users, 29% said they increased their usage during the pandemic. In this case, the highest users come from millennials at 40% and Gen X at 39%.

Globally, the segment is going to grow at a compound annual growth rate (CAGR) of 19.8% from 2020 to 2027. This is from the $1.06 trillion transaction value of contactless payments in 2019.

Countries around the world are also passing legislation to support the technology. According to the report, 48 countries increased spending limits on touchless transactions. This comes out to an average of 131% increase in transaction limits after the pandemic.

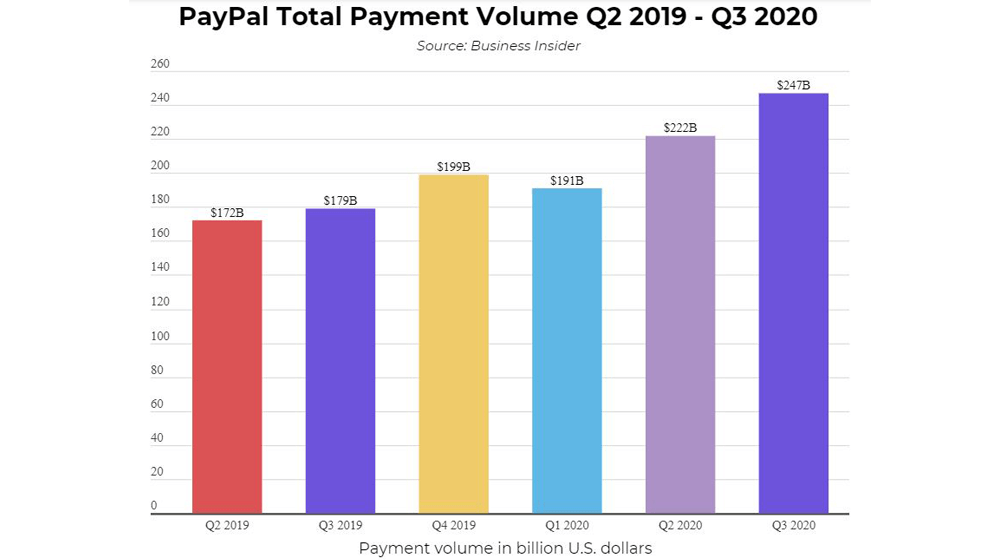

Another data point from the report is the growth of PayPal. The company experienced its strongest growth ever in payment volume during the past quarter. With a 36% YoY volume increase, PayPal reached $247 billion this quarter, up from $179 billion in Q3 2019. The 15 million new accounts also did not hurt, which now brings the total to 361 million.

Payment Flexibility

The large growth of PayPal in the third quarter, as well as the number of people using contactless payment solutions, shows consumers want more ways to pay. As a small business, payment flexibility is key to staying competitive as we move from the pandemic.

Image: compraracciones.com

This article, “40% of Americans Use Cash Less Frequently in 2020” was first published on Small Business Trends