This is the biggest benefit trend of COVID-19: At a time of collective grief, uncertainty and anxiety, there is a new spotlight on how employers treat their employees. It’s not just about salary or nice-to-have perks—it’s getting to a deeper, more meaningful level. How do you help them cope? How do you show them you have their back? What resources can you provide? What flexibility? What recognition? What leeway? Read more here.

John Hancock latest to sign on to virtual camp trend: Another employer has turned to a free virtual camp perk—amid other new benefits—to help its employees who are struggling to take care of their children during the pandemic. John Hancock’s four-week camp for its employees and their children kicked off July 20 with more than 3,000 campers. Content includes a mix of online and offline curriculum that can be done with minimal parental supervision for kids ages 4-10. The activities also include hands-on STEM and art activities, a pen pal program, a chore chart, arts and crafts, music and story time and a camp singalong. Read more here.

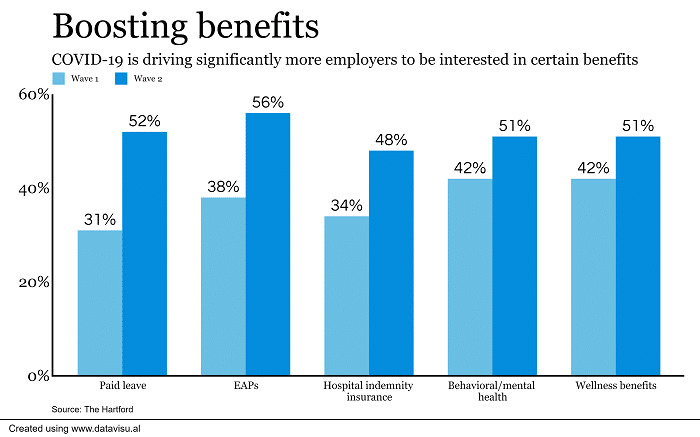

COVID-19 is changing how employees view their benefits: Although the coronavirus pandemic has put employee benefits in a new spotlight, the crisis also has caused a drop in how employees perceive the value of their offerings and their trust in their company to make the best benefits decisions, a new analysis finds. Research out from The Hartford—which polled U.S. workers and human resources and benefits decision-makers in early March, just before the COVID-19 outbreak in the U.S., and again in mid-June, finds that 73% of employees now say they value the insurance benefits their company offers them, down from 80% three months earlier. The percentage of employees who say they trust their company is making the best decisions about the benefits available dropped six percentage points, from 61% in wave one of the study to 55% in wave two. Read more here.

COVID-19 is changing how employees view their benefits: Although the coronavirus pandemic has put employee benefits in a new spotlight, the crisis also has caused a drop in how employees perceive the value of their offerings and their trust in their company to make the best benefits decisions, a new analysis finds. Research out from The Hartford—which polled U.S. workers and human resources and benefits decision-makers in early March, just before the COVID-19 outbreak in the U.S., and again in mid-June, finds that 73% of employees now say they value the insurance benefits their company offers them, down from 80% three months earlier. The percentage of employees who say they trust their company is making the best decisions about the benefits available dropped six percentage points, from 61% in wave one of the study to 55% in wave two. Read more here.

HR leaders: Give workers ‘permission’ to disconnect: It’s time to consider vacation nudges, including artificial holidays, Fridays off and more. Read more here.

Employers prep for virtual open enrollment: Well over half of employers say their company’s open enrollment strategy will depend more strongly on online resources this year because of the coronavirus pandemic, according to new research from The Hartford. A look at what that means to HR leaders. Read more here.

How Bank of America is supporting working parents: Childcare can be both complex to set up and costly during normal times—factor in COVID-19 and the reality that most kids aren’t going to back to full-time in-person instruction this fall, and working parents have another cascade of obstacles to overcome. Bank of America is seeking to alleviate some of that uncertainty with a host of childcare support initiatives. Read more here.

How a ‘menu of options’ can ease the childcare burden: Paylocity is in the process of rolling out a “menu of options” to help employees—nearly all of whom have been working remotely since March—to manage the work/life integration. Plans that could be considered include split schedules, such as a several-hour break in the middle of the day for caregiving; a four-day week with 10 hours; swapping a weekday for working on a weekend day; and reduced hours until schools resume in-person operations. Read more here.

COVID-19 accelerates uptick in remote work, wellbeing: ‘Never waste a good crisis,’ one expert says as more employers embrace innovations in employee engagement. Read more here.

A ‘tail’ in improving employee wellness: pet adoption assistance: The Zebra, an Austin-based insurance comparison website, this year rolled out an extremely rare benefit: covering expenses up to $300 annually for employees adopting a new cat or dog into their family. The company says the pet adoption benefit pays big dividends in employee morale and wellbeing—especially during the coronavirus pandemic. The pandemic has not only resulted in pet owners spending significantly more time at home with their pets, but it’s prompting an exponential increase in pet adoptions. Read more here.

COVID income data paints bleak financial picture: More than half of people say they’re currently earning half or less of their pre-pandemic income, according to a survey of more than 1,100 U.S.-based respondents from FlexJobs, which was fielded in partnership with Prudential. Additionally, 46% say their emergency savings wouldn’t last them more than three months and roughly a quarter (24%) said their savings wouldn’t last one month. Overall, 62% do not have enough emergency savings to last six months. Read more here.