There was an encouraging rebound for small business loan approval rates for banks and non-bank lenders during July. This is according to the Biz2Credit Small Business Lending Index released recently.

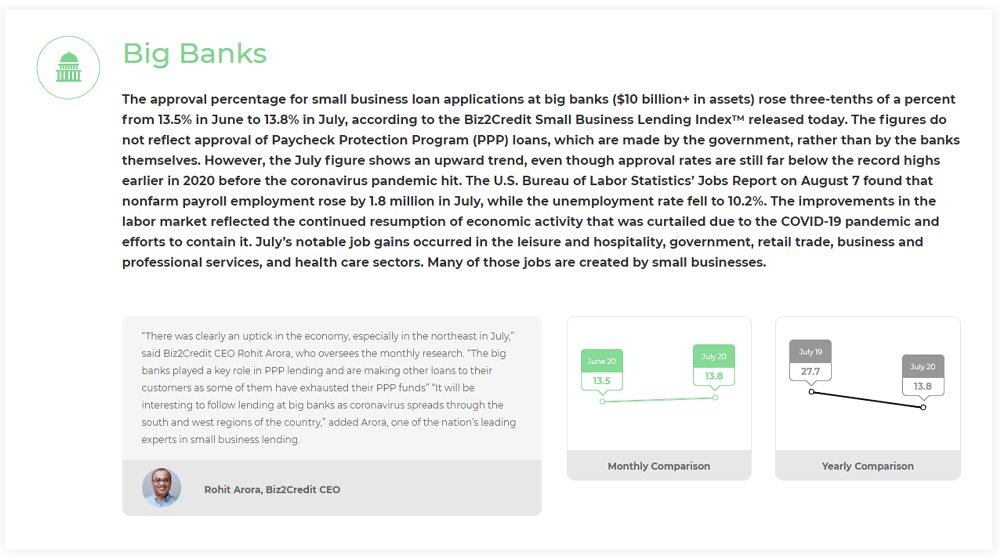

The approval rates show an increase of 0.3% in the approval percentage for small business loan applications at big banks. This approval rate increase does not include Paycheck Protection Program (PPP) loans. It also only applies to big banks with $10 billion or more in assets.

Biz2Credit Lending Index July 2020

The small business loan approval rate was 13.5% in June and rose to 13.8% last month. Small bank approval rates rose 0.2% to 18.6%, with both big and smaller bank approvals still massively below February’s 50.3%.

Encouraging Approval Rate Trend for Small Businesses

While the loan approval rate rise appears incremental, the upward motion is still encouraging for small businesses in the US. This is clearly a small sliver of good news for small businesses who may need such loans to stay afloat. Customer numbers and revenues are still down for many businesses, but hopefully the upward trend will continue.

Other improvements in the labor market show that a slow resumption of economic activity continues. The health care sector has seen a significant jobs boost. There were also notable job gains in the leisure and hospitality, retail trade, business, and professional services sectors. A lot of these jobs have been created by small businesses who are clearly vital to the economy’s recovery.

Institutional Lenders ‘Steadily Climbing Back’

The monthly research by Biz2Credit is overseen by their CEO and leading small business lending expert, Rohit Arora, who commented: “There was clearly an uptick in the economy, especially in the northeast in July. The big banks played a key role in PPP lending and are making other loans to their customers as some of them have exhausted their PPP funds.

“It will be interesting to follow lending at big banks as coronavirus spreads through the south and west regions of the country.”

Arora also said that regional and community banks are now making other types of loans available to new customers. Previously they had only been making a lot of PPP loans available to small businesses.

“The smaller banks are now in a good position to resume making SBA 7(a) loans and other funding requests,” added Arora. “Institutional lenders, like the other types of lenders, are steadily climbing back after disastrous results in March and April. They continue to play a strong role in small business lending.”

Alternative Lenders and Credit Unions Continue Struggling

The loan approval rate increase among big and small banks is unfortunately in contrast to the rates among alternative lenders. They dropped 0.3% between June and July. The loan approval rate for alternative lenders now stands at 23.1%.

Credit union approvals also saw a slight drop in July, approving 21.2% of loan requests. That is a decrease of 0.15% to return to the same 21.2% approval rate from May.

READ MORE:

Image: Depositphotos.com

This article, “Small Business Bank Loan Approval Rates Improving, New Biz2Credit Data Shows” was first published on Small Business Trends