The Biz2Credit Small Business Lending Index for June 2020 is reporting small business loan approval rates continue to rebound.

Biz2Credit Small Business Lending Index June 2020

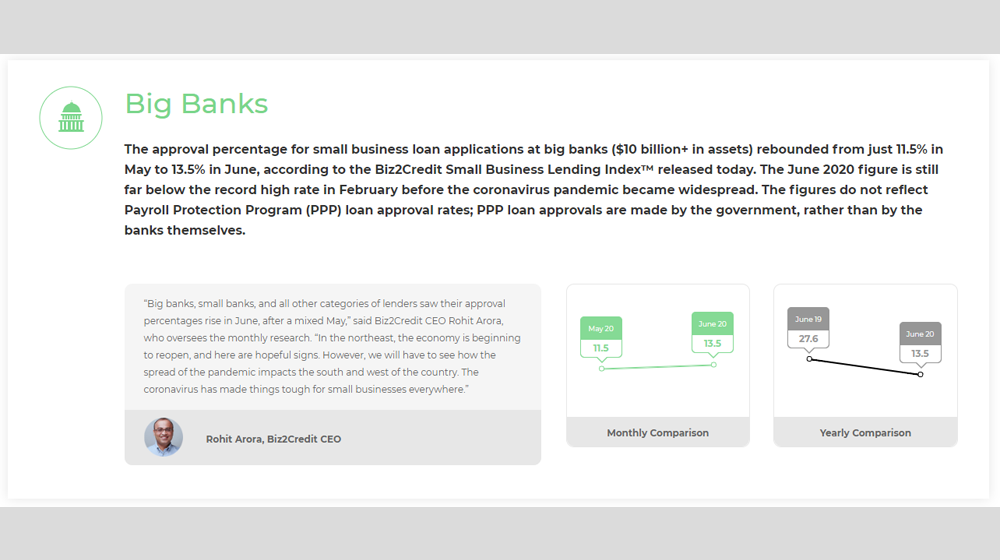

Applications for small business loans rebounded from 11.5% in May to 13.5% in June, the Index shows. June’s figures are significantly lower than February 2020, when a record-high figure was recorded prior to the Covid-19 pandemic. The figures are based on bank loans rather than approvals of the Payroll Protection Program loans, made by the government.

Positive Signs for Small Businesses

Rebounding loan approval rates is a positive sign for small businesses seeking to secure funds to expand or start ventures. Raising this point, Rohit Arora, Biz2Credit CEO, who oversees the monthly reports, said: “Big banks, small banks, and all other categories of lenders saw their approval percentages rise in June. In the northeast, the economy is beginning to reopen, and there are hopeful signs.

“However, we will have to see how the spread of the pandemic impacts the south and west of the country. The coronavirus has made things tough for small businesses everywhere,” Arora added.

The Biz2Credit Small Business Lending Index analyses loan requests of more than 1,000 small business owners. The businesses who applied for funding on Biz2Credit’s platform have been in business for more than two years.

Data from the Biz2Credit Small Business Lending Index

The data shows that smaller banks are playing a pivotal role in the success of small businesses. Loan approval rates at small banks increased in June to 18.4%. This was up from 16.9% in May. In February 2020, loan approval rates were a much more robust 50.3%.

Keeping Americans in Jobs

To June 30, 2020, Payroll Protection Program (PPP) loans have provided more than 4.9 million small businesses with funding. The $521 billion-plus in funding small businesses have received, have kept around 50 million Americans in work. This was the finding of a report by the US Small Business Administration (SBA).

The average size of PPP loans is $106,772. 5,460 lenders have participated in the program so far.

Institutional Lenders Playing an Important Role in Small Business Funding

The number of loans granted by institutional lenders has risen steadily from 21.4% in May to 21.6% in June. Borrowing from institutional lenders often means small businesses can get their hands on cash more quickly. Arora believes institutional lenders will play an important part in small business funding as the economy emerges from the pandemic.

The number of loans approved by credit unions increased slightly, from 21.2% in May to 21.35% in June.

The Biz2Credit Small Business Lending Index for June 2020 provides an optimistic outlook for small businesses and the economy. It also shows the importance of the availability of small business loans to help businesses navigate these difficult times.

READ MORE:

Image: Biz2Credit.com

This article, “Small Business Loan Approval Rate Continues to Rebound” was first published on Small Business Trends