America is in the midst of a healthcare affordability crisis – and not just for the uninsured. The Kaiser Family Foundation recently reported that the average single deductible for health insurance is about $1,400. The average family deductible is nearly $4,000[1]. And about half of the families in America have only $400 set aside to pay for emergency expenses.[2]

That leaves millions facing an unexpected health emergency with a payment gap starting at $1,000. More and more, people fully employed and enrolled in a healthcare plan cannot afford to access care.

And it’s not just deductibles that have gone sky high. Mercer found that the median out-of-pocket maximum for family coverage in a PPO plan is $7,000 in-network and $12,00 out-of-network (and it’s even higher for HDHPs and HMOs).[3]

Even with all the cost shifting to employees over the last 10 years, employers are still experiencing health care cost problems themselves. According to another Kaiser report, employer healthcare costs have risen 61% over the last decade, which is truly unsustainable[4].

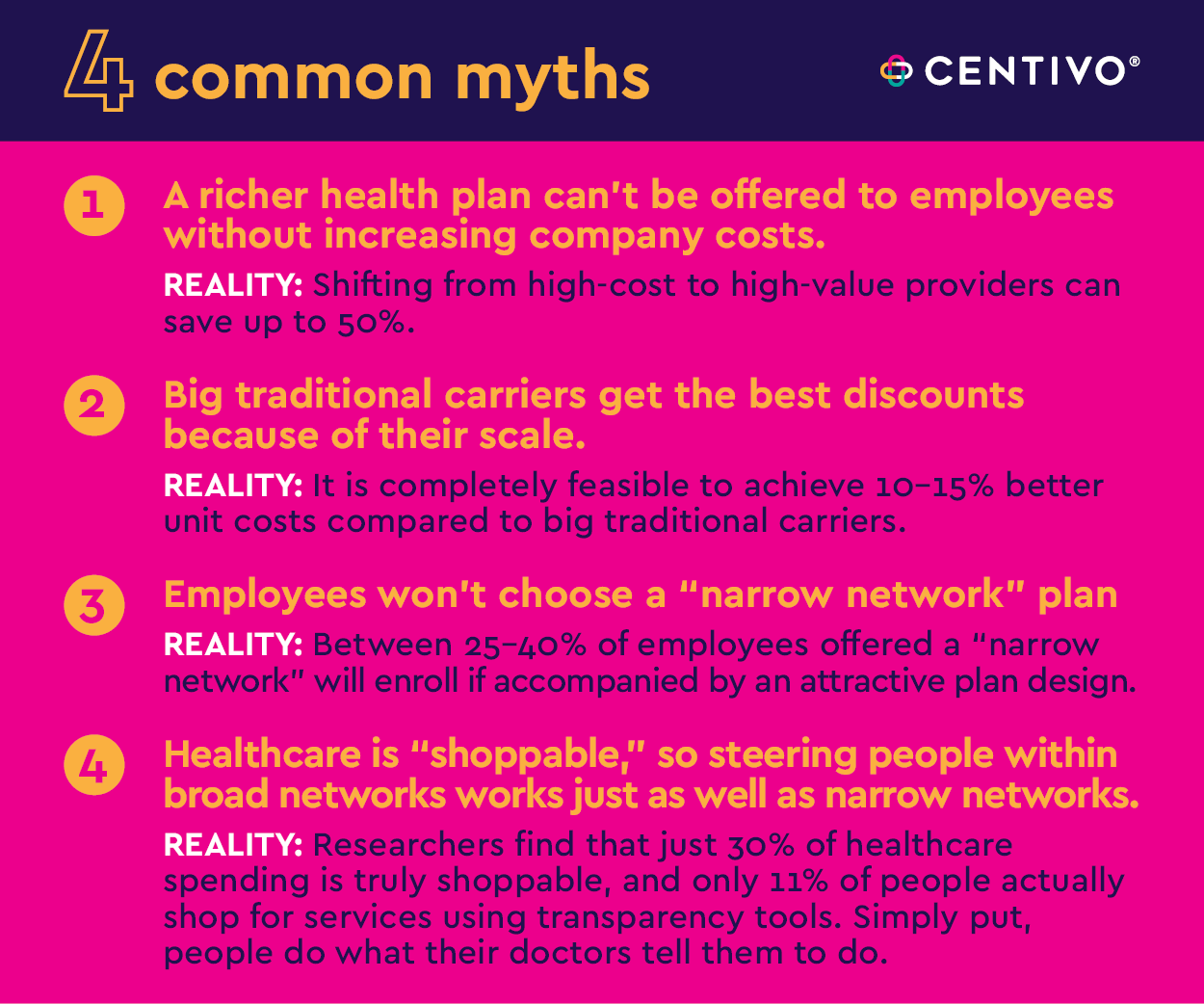

In order to move forward with a solution, it’s essential to dispel the myths that have somehow become the conventional wisdom surrounding employer-sponsored health plans.

Here is a reality-check for 4 of the most common myths:

MYTH 1: A richer health plan can’t be offered to employees without increasing company costs.

REALITY: Shifting from high-cost to high-value providers can save up to 50%[5].

This can be done by building networks anchored around high-value providers, with advanced primary care as a centerpiece. Such networks offer huge savings on two fronts: first, high-value providers charge lower unit cost by definition and are keenly aware of the need to maintain their low costs as a competitive advantage versus other in-market providers. Second, high-value providers reduce unnecessary utilization (for example, they may not be as quick as others to send patients to surgery).

MYTH 2: Big traditional carriers get the best discounts because of their scale.

REALITY: It is completely feasible to achieve 10-15% better unit costs compared to big traditional carriers.

Traditional carriers are so big that their overall leverage for driving down costs for a particular line of business can be limited. For example, Carrier A doesn’t want to get too aggressive with a health system about pricing for commercial plans, because that could impact their Medicare business with that system. In addition, as a for-profit company, Carrier A needs to find its profit somewhere. And that’s far easier to find in commercial plan clients that have long accepted the annual cost increase as status quo. Newer, innovative health plans can build a network of only high-value providers, cutting these providers’ competitors out of the network. These high-value providers will reduce their rates to be the only provider in the network, therefore getting all the patients. This is especially true for health provider systems that feel they have made great strides in their value-based care models and are not being rewarded for it by the big traditional legacy carriers.

MYTH 3: Employees won’t choose a “narrow network” plan.

REALITY: Between 25-40% of employees offered a “narrow network” will enroll if accompanied by an attractive plan design.

Cost remains the biggest concern for consumers when it comes to healthcare.[6] Access to cost savings is often incentive enough for employees to select a narrow network, especially if it comes with higher value, richer benefits, and lower contributions. The key is to offer real, measurable cost differential among plan options, and not “expensive, very expensive, and insanely expensive.”

MYTH 4: Healthcare is “shoppable,” so steering people within broad networks works just as well as narrow networks.

REALITY: Researchers find that just 30% of healthcare spending is truly shoppable[7], and only 11% of people actually shop for services using transparency tools[8]. Simply put, people do what their doctors tell them to do.

In theory, consumers have access to all sorts of transparency tools and other resources that help them identify the right provider, in the right place, at the right time. (This is the promised magic of consumerism, which was going to miraculously fix everything wrong in the broken US health system). In reality, consumers find these tools difficult to use and make sense of in a meaningful way, and so they put their trust in the advice of their doctors. But doctors often make referrals with little regard to cost and quality outcomes. For example, a recent study revealed that 51% of cost variations in MRIs were explicitly linked to referrals[9]. Referrals must be driven by data, meaning PCPs refer only to specialists who score well on quality and cost metrics, instead of habit, personal relationships, or assumed convenience.

The other stark reality is that even if the transparency tools and information were great and up to date, so much of the really expensive care is not shoppable at all. Employers MUST re-focus their attention on the supply side of healthcare – and realize that putting all their eggs in the “shopping” basket is just not realistic or fair.

A Model That Works

There is a model that busts these myths wide open and offers truly valuable, measurable solutions. A model that brings primary care into the center of the member experience and anchors itself on quality, affordable, accountable care and the systems that provide it. That gives employers real savings while offering a plan without the financial barriers like high deductibles and coinsurance. And it’s working, today, in the real world.

Centivo, a new health plan for self-funded employers anchored around leading providers of value-based care, has brought this model to life in key markets throughout the country. The results have been nothing short of remarkable. To learn how Centivo is helping self-funded employers achieve savings of 15% or more compared to traditional carriers, talk to your benefits broker or reach out at centivo.com/contact.

[1] “Average Annual Deductible per Enrolled Employee in Employer-Based Health Insurance for Single and Family Coverage,” Kaiser Family Foundation. Can be found at Average Annual Deductible per Enrolled Employee in Employer-Based Health Insurance for Single and Family Coverage

[2] “Report on Economic Well-Being of US Households 2019 – May 2020,” Federal Reserve, May 21, 2021. Can be found at Report on Economic Well-Being of US Households 2019 – May 2020

[3]Mercer National Survey of Employer-Sponsored Health Plans, 2020, Mercer, April 2021. Can be found at Mercer National Survey of Employer-Sponsored Health Plans, 2020

[4] Kaiser Family Foundation Employer Health Benefits Survey 2018-2020; Kaiser/HRET Survey of Employer-Sponsored Health Benefits, 1999-2017. Can be found at 2020 Employer Health Benefits Chart Pack | KFF

[5] Internal Centivo research

[6] “Healthcare Costs Still a Major Concern,” Chris Merkel, Lewis & Ellis, 2021. Can be found at: Healthcare Costs Still a Major Concern

[7] “Reference Pricing: A Small Piece of the Health Care Price and Quality Puzzle,” Research Brief, National Institute for Health Care Reform, October 2014. Can be found at Reference Pricing: A Small Piece of the Health Care Price and Quality Puzzle.

[8] “Are Health Care Services Shoppable? Evidence from the Consumption of Lower-Limb MRI Scans,” National Bureau of Economic Research, January 2019. Can be found at Are Health Care Services Shoppable? Evidence from the Consumption of Lower-Limb MRI Scans.

[9] “Are Health Care Services Shoppable? Evidence from the Consumption of Lower-Limb MRI Scans,” Michael Chernew, Zachary Cooper, Eugene Larsen-Hallock, and Fiona Scott Morton, NBER, ISPS Working Paper, July 30, 2018. Can be found at Are Health Care Services Shoppable? Evidence from the Consumption of Lower-Limb MRI Scans.