The seemingly never-ending rise in gas prices across the United States caused the IRS on Thursday to raise its standard mileage deduction rate for 2022.

The raise announced today will go in effect on July 1 through the end of 2022. The new rate is 62.5 cents per mile for business use of an automobile. That’s 4 cents more than the 58.5 cents the IRS is reimbursing through June.

The new mileage deduction rate for moving and medical expense uses of a vehicle is up to 22 cents, starting on July 1. That’s up from 18 cents in the first half of 2022.

Here’s a breakdown of the changes:

Updated 2022 Standard Mileage Deduction Rate

| Vehicle use | Mileage rate Jan. 1-June 30, 2022 (cents per mile) | Mileage rate July 1-Dec. 31, 2022 (cents per mile) |

|---|---|---|

| Business | 58.5 | 62.5 |

| Moving/Medical | 18 | 22 |

| Charitable | 14 | 14 |

IRS Updates Standard Mileage Deduction Rates for Remainder of 2022

The standard mileage deduction can be used to determine the deductible costs of using a vehicle for business purposes. A taxpayer does retain the option of calculating the “actual costs” of using their vehicle for business purposes rather than taking the standard mileage deduction rate.

“In recognition of recent gasoline price increases, the IRS made this special adjustment for the final months of 2022,” the IRS says in an email newsletter update to subscribers on Thursday.

“The IRS is adjusting the standard mileage rates to better reflect the recent increase in fuel prices. We are aware a number of unusual factors have come into play involving fuel costs, and we are taking this special step to help taxpayers, businesses and others who use this rate,” IRS Commissioner Chuck Rettig says.

Normally, the IRS updates its standard mileage deduction near the end of a calendar year.

Any business travel expenses recorded during the first half of 2022 (through the end of June) should still apply the 58.5 cents rate

Rise in Gas Prices Mostly Influenced IRS Decision to Update Mileage Deduction Rate

The skyrocketing gas prices impacting all American businesses is mostly to blame for this update from the IRS. But the agency says other factors like depreciation and insurance costs also factored into it.

But the decision was mainly due to rising gas prices and the IRS had been hearing from elected officials recently about the need to update the standard mileage rate in the middle of this year to help offset that specific rising cost.

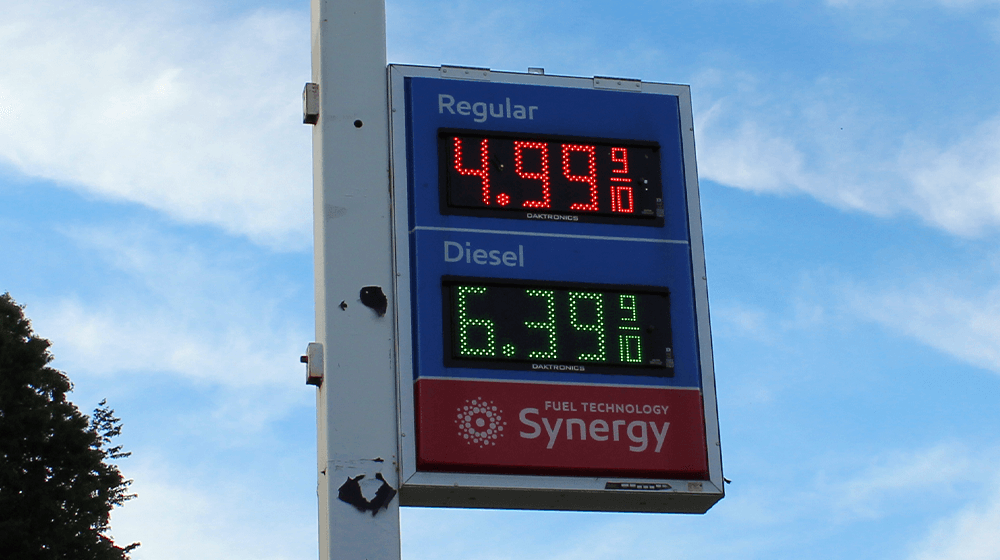

Gas prices nationwide set new record highs on Thursday. According to AAA.com, the average price of regular unleaded gas in the US is $4.97. The record-high price for a gallon of diesel is now $5.74.

The move is not without precedent. IRS notes that it last updated the mileage deduction rate mid-year back in 2011.

RELATED:

- IRS Announces 2022 Mileage Reimbursement Rate

- Congressmen Ask IRS to Increase Mileage Reimbursement Rate

Photo: Small Business Trends

This article, “IRS Raising 2022 Standard Mileage Deduction Rate As Gas Prices Soar” was first published on Small Business Trends