According to WorkTech‘s most recent market update report, the first half of 2024 saw HR tech investment activity return to healthy, pre-2021 levels—before the market experienced irrational spikes in 2021 and early 2022.

According to the company’s founder, George LaRocque, work tech is a unique segment, viewed as the next evolution of solutions of interest to CHROs and their teams. “We see work tech as the new category of HR tech,” says LaRocque. He says that despite challenges in raising capital, the sector has performed well, especially compared to the broader B2B tech market.

Consistent investment highlights the ongoing importance and growth of HR tech, which reached $2.22 billion globally across 114 deals in the first half of 2024.

WorkTech survey data shows the sales pipeline for HR tech is robust for this year so far. As for employer spend, WorkTech research shows that just over 70% of employers expected their “hiring work tech budgets” to grow or stay the same this year compared to next year. Organizations in manufacturing, healthcare, retail and technology stated the largest growth in their budgets, with an average increase of just below 50%.

Adoption drivers—features that compel an org to make an HR technology purchase—include improvement in quality of hire, efficiency and speed, and user experience. CHROs are also looking for solutions with fewer interfaces, robust future roadmaps and a strong partner ecosystem.

Market impact of AI-driven productivity

Despite all the buzz about artificial intelligence, the topic isn’t making start-up stories more compelling. “AI is not a differentiator,” says LaRocque. “What you’re doing with AI might be a differentiator, but everybody’s got AI.”

However, this element of the market is still taking shape, and LaRocque says it’s difficult to predict which solutions will pull out ahead in the future. “We are likely to see someone jump into that bigger slice of the market share pie,” he says.

LaRocque anticipates that HR tech buyers won’t sign any purchase contracts based on AI-driven features, no matter how slick. He says new chatbots, co-pilots and conversational interfaces are improving the experience for HR, employees and candidates. However, these improvements aren’t enough on their own.

“There’s a lot of cool stuff happening,” he says, warning that the AI game is still in early stages. Though many aspirational designs of the past few years are now becoming a reality, the “automation onslaught” requires strategy at the employer level, an activity drawing the attention of many CHROs right now.

Investors struggle to understand the talent category

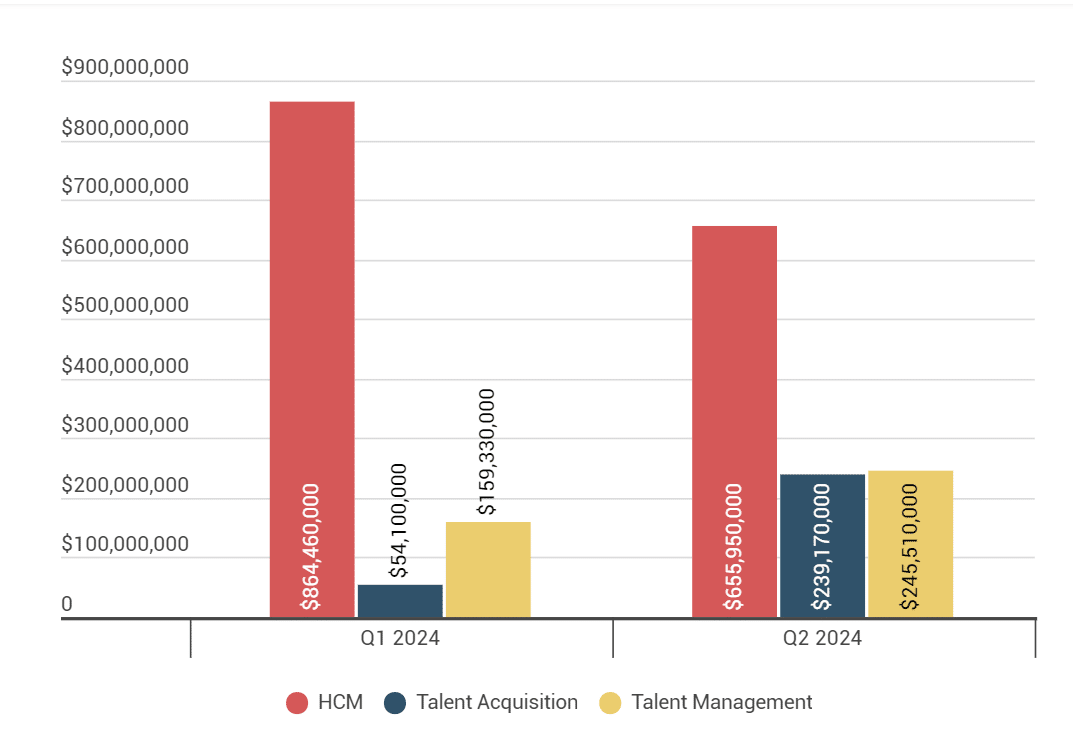

Core HR solutions lead investment momentum, and since 2020, HCM has consistently led in both dollar volume and average deal size, according to WorkTech. In comparison, talent acquisition typically attracts 40% to 60% of the total investment seen in HCM, involving more deals with a smaller average deal size.

The talent acquisition market is nuanced, comprising over 25 subcategories, many of which are experiencing significant revenue growth and adoption, says LaRoque. Despite this, many investors struggle to grasp the complexities of the recruiting landscape. Macroeconomic trends and job market fluctuations have broadly impacted hiring, making investors hesitant about talent acquisition tech.

This hesitation presents a potential opportunity for investors who understand these nuances, especially those focusing on early-stage investments (pre-seed through Series A). LaRocque says investors willing to put effort into understanding the talent segment of the market, particularly those who are from the industry or work with consultants familiar with the HR tech industry, could be winners in upcoming quarters. “There’s a lot of opportunity hidden in this [news] about talent acquisition,” says LaRocque.

There’s one area of TA that deserves to be highlighted, says LaRocque. “Even in this market, when TA is getting hit, marketplace job boards are one of the top seven categories, out of 27 subcategories that we saw represented in Q2.”

LaRocque says that job boards have evolved into marketplaces with deeper capabilities that add in skills, training, career services and more. “That’s what turns you from a job board to a marketplace,” he says. “This is a space where investors could find some incredible gems.”

Historical context of investment trends

LaRocque consistently warns that a quarter doesn’t make a trend, a reminder to look back while looking forward. The first half of 2024 reflects robust performance similar to 2018 through 2020, according to WorkTech.

During that period, quarterly investments ranged from 2x to 9x higher than in previous quarters. The sharp rise in 2021 and early 2022, followed by a steep decline, distorted the perception of historical performance, says LaRocque.

When viewed without the anomaly of those peak quarters, the current pace—while lower than the record-setting 2021 and early 2022—is still strong, according to WorkTech. Performance from the second half of 2022 to now appears better, indicating that raising VC remains challenging, but regression is not as severe as it might seem.

Q2 2024 performance

Though the most recent WorkTech report wrapped up year-to-date 2024, LaRocque also reported on Q2 data. In Q2 2024, global investment in HR tech reached $1.14 billion across 64 deals. According to WorkTech, this continues the consistent investment trend observed from 2018 through 2020 and marks a 43% increase over results from the second half of 2023.

Notable Q2 2024 deals

Core HR: Rippling ($200M)

HR suite: Factorial ($80M)

Workforce management: Legion Technologies ($50M)

Marketplace job board: ShiftMed ($47M)

Learning: Learn to Win ($30M)

Chatbot/conversational/messaging: Hippocratic AI ($53M)

Assessment: KarmaCheck ($45M)

During Q2 2024, 22 countries participated in 64 global HR tech investments. The U.S. led with 31 deals, followed by the U.K. with eight, according to LaRocque’s report. Other countries—including Australia, the Netherlands and Spain—each reported two or fewer deals.

Q2 included one “mega-round,” according to WorkTech, with Rippling’s $200 million Series F round being the largest deal of the quarter, focused on its SMB Core HR product. “Rippling found a really interesting niche,” says LaRocque.

Meet George LaRocque, Investor Summit chair, at HR Tech this fall in Vegas. Register now.

The post Led by HCM, $2.2 billion invested in HR tech so far in 2024 appeared first on HR Executive.