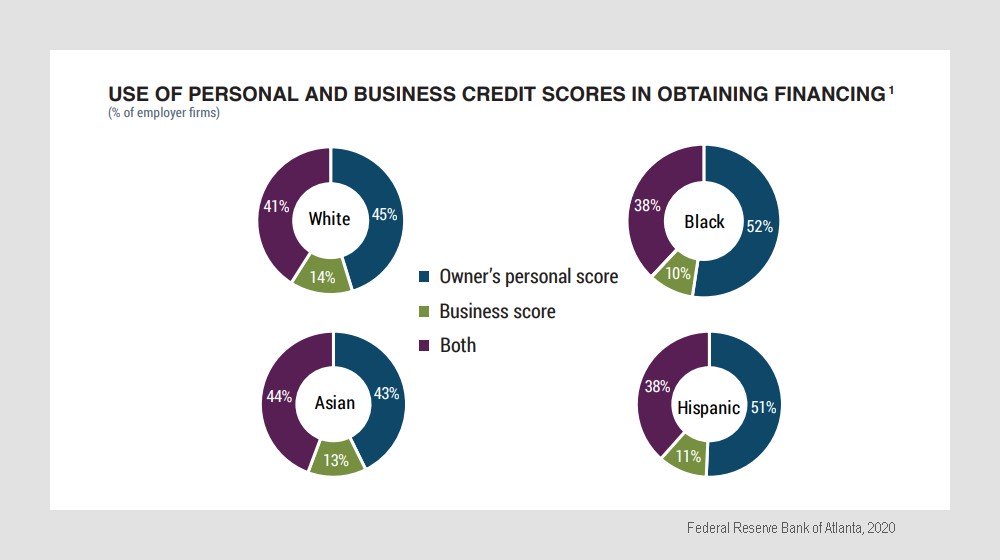

When seeking financing, minority business owners are more likely to be at a disadvantage compared with non-minorities. Part of it has to do with credit scores:

- Minorities are more likely to rely on their personal credit scores, versus business credit scores. That’s important to know because personal scores are often lower for Blacks and Hispanics than for other owners.

- Minorities tend to get more adverse financing decisions. For example, they may not get all the financing they applied for.

- Finally, minorities are more likely to pursue higher-cost financing like cash advances.

Background

The information comes from a Report on Minority Owned Firms study released by the Federal Reserve Bank of Atlanta in 2020.

According to the study, over half of Black and Hispanic owners (52% and 51% respectively) rely only on their personal credit scores when seeking financing. By comparison, White-owned firms are more likely to rely on business credit ratings, with just 45% relying on personal scores.

As background, it’s important to understand how business financing works. Large corporations typically get financing solely based solely on the business’s credit standing. Small businesses, on the other hand, may be seen as closely identified with the owner. Therefore, lenders often look at both business and personal credit histories and require the owner to personally guarantee the business loan. But if the owner applies for, say, a personal home equity loan and uses the money for the business, the decision would be based solely on the owner’s personal record.

So why exactly do minority small business owners rely solely on personal credit scores instead of their business credit?

One reason may be that they have no choice. The business may lack a well-established credit history. For example, sole proprietorships and new startups simply may not have a credit history in the firm’s name. The businesses are too new or inseparable from the owner.

Owners also may be forced to rely primarily on personal credit because their business revenues, profits or cash flow are low.

Minority Owner Personal Credit Scores

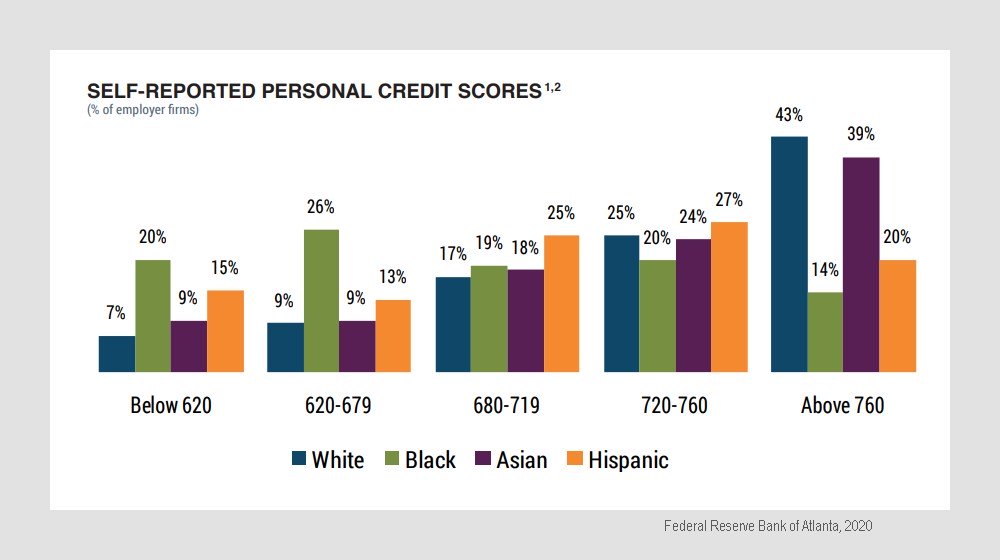

Credit bureaus interpret scores differently. But according to Experian, a good personal score is 700 or above. A bad credit score is generally below 670. That’s on a scale of 300 to 850.

- Black business owners are more likely to report personal credit scores that fall in the “bad” range below 670.

- White and Asian business owners, on the other hand, are two to three times more likely to have credit in the “very good” range above 760.

The chart below shows the personal credit scores of study participants. You can see the stark differences.

The study also found that Hispanics and Blacks more often ended up with less-attractive, higher-cost financing options. For example, Hispanic-owned firms sought merchant cash advances more frequently than White-owned businesses (15% compared with 8%). Black applicants applied for factoring more frequently compared to White-owned firms (7% compared with 3%). Cash advances and factoring tend to have higher fees and interest rates.

Having a low credit score can mean the owner gets less money than needed. When citing reasons for getting less financing, 44% of minorities cited a low personal credit score. That’s compared with just 32% of White-owned businesses. (Report on Minority Owned Firms, p. 11)

3 Steps to Better Minority Business Credit

What steps can minority business owners take to make sure they get the financing they need for their businesses? Three things stand out:

- Try to improve your personal credit score. You may need a business loan, but your personal score still matters.

- Improve your business credit history so you can also rely on your firm’s credit rating. The more you establish a separate business history, the more financing options you have.

- Take action now, before you need money. It takes time to improve credit. You don’t want to be forced into unattractive financing at the last minute because you are desperate.

This article, “Minorities Rely More on Personal Credit Scores vs Business Scores” was first published on Small Business Trends