Small business already know about the shortcomings of the first go around of the Paycheck Protection Program (PPP). Where “small businesses” like Ruth Chris’ Steakhouse was able to get $20 million or so, while other real small businesses looking for $5,000 to just stay afloat were turned away.

But with the new PPP round currently taking place, there’s renewed hope that companies left out of the first go around, especially black and brown businesses, will finally benefit from the program due to changes aimed it benefitting companies at the low end of the small business sector.

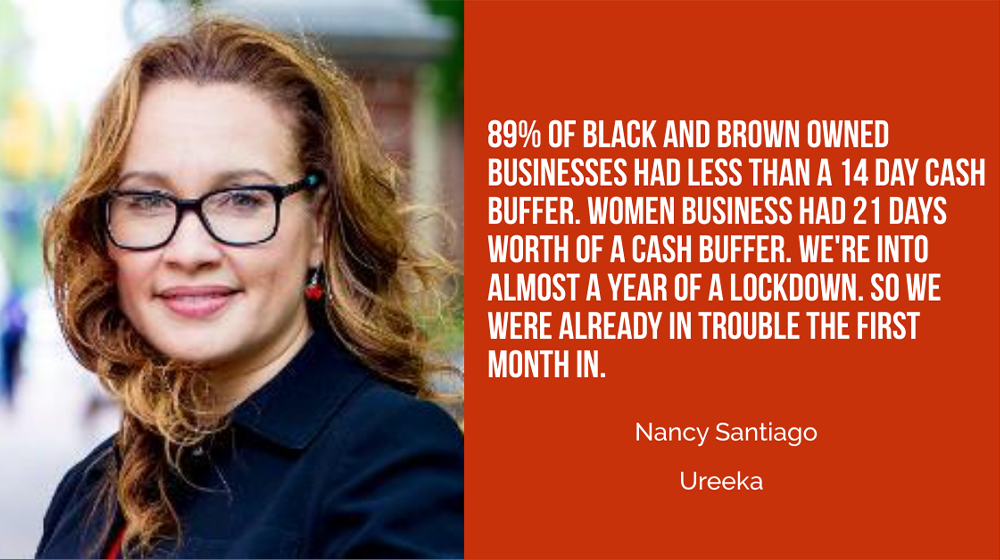

Nancy Santiago, Community Impact Lead for Ureeka, a startup founded that provides mentorship and guidance through their platform to help entrepreneurs’ get answers to their most pressing questions, joins me to share what small businesses need to know about applying for this round of PPP. Below is an edited transcript of a portion of our conversation. To hear the full conversation click on the embedded SoundCloud player.

PPP – Missing the Mark the First Time Around

Brent Leary: Can you tell us about the original purpose of PPP, what happened the first go around, particularly when it comes to small businesses, and even more particular when it comes to small businesses of color?

Nancy Santiago: We missed the mark with PPP, as a country. Let’s talk about the fact that it was asked to be scaled out by a government agency that quite honestly, has never done well by black, or brown small business owners to begin with. Shame on us because we’ve not really pushed the needle on the fact that the SBA, and other entities in government still were only lending it 2% for African-American small business owners, and small midsize businesses.

Let’s start with that problem. We’ve never addressed it as a country. Congress never called the question about whether we were doing right by those small business owners, or mid-sized business owners to begin with. Then we plop all of this money down to be pushed out through that same system, and expect it to somehow magically make it to black and Brown business owners. How? The system itself was only getting 2% out on its best day, so how did we expect that to happen.

Sole Proprietors Left Out of PPP 1

Then add to the fact that we had all kinds of other barriers. If you look at the percentages of black and brown owned businesses that are sole proprietorship, they are the majority in our communities. When you think about the fact that we were asking only small businesses that had two, or more employees to apply, where we’ve left out an entire community, or communities, plural. Those were the beginning stages. We had an agency that really hadn’t done a particularly good job in serving communities of color, now in charge of rolling out the money. So, problematic.

Second problem was that it rolled out so quickly with so many unanswered questions that, the devil is in the detail. I tell people all the time, good policy is only good policy if it’s implemented well. That we were missing as well. Then the sole proprietorship also continues to be a problem for us.

No Bank Relationship, No PPP First Go Around

The last huge obstacle were relationships with banks. You needed to have some good previously existing relationship with a bank to be able to get this done. We know very well that black and Brown communities don’t have great existing relationships with our banks in this country. If they did, the community reinvestment act, wouldn’t be. It exists because we’ve not done that work well. All those things combined, made the rollout for communities of color, and the ability for us to access PPP dollars. Really pretty disastrous when you talked about 90% of businesses of color were locked out of the first traunch.

PPP2 Fixes Some Issues

Let me get to the second traunch. Gets a little bit better because you start to use the entities like CDFIs (Community development financial institutions), and other non-profit lenders that have a mission around community. You engage them so the numbers get a little better, and that’s great. But again, we’ve not invested in helping the CDFIs, and other institutions like community credit unions, and community banks to really expand their reach, and their ability to move capital. Even they were limited with their bandwidth.

We’re going to get a different focus, but we also now have an opportunity for sole proprietorships to be eligible for PPP. We also now have a well-established systems where CDFIs community credit unions, and other nonprofit and community financial institutions can engage in the process. They’ve proven to us time and time again, that they can get the dollars out to the communities that needed the most.

I’m hoping that those things combined, plus the fact that people now have had some experience with this process, makes us a little bit more well-prepared to take advantage of this opportunity. But a two week window is tough to begin with, and really scary when you’re trying to keep the lights on, doors open, feed your families, and manage to stay safe from global pandemic. We still have a lot of things. It’s still an uphill battle, but I do feel like we have some more wiggle room than we’ve had in the last go rounds of PPP.

Brent Leary: Does the two week window already started? Or is it?

Nancy Santiago: Sorry. It’s already started. We have to think about how we start to move folks. The truth of the matter is that it was supposed to be rolling out very quickly, as we know, to be able to get people moving in the right direction fast. We don’t have a lot of time. I tell people all the time for the small business owners of color, they were already out of time when this started.

If you think about 89% of black and Brown owned businesses had less than a 14 day cash buffer. We’re into almost a year of a lockdown, and when you add women into the mix, 21 days worth of a cash buffer, but we were already in trouble the first month out.

Everything we’re doing now is attempting to catch people up where the reality is, as I said before, we need to be leapfrogging. That’s what we’re attempting to do at least in this process. Help leapfrog some of the smaller business owners who weren’t eligible for the first rounds of PPP, to now come in and get what they need, get the information they need, help them build the documentation that they need to be able to take advantage of this round.

Getting Ready to Apply for PPP2

Brent Leary: Would the first step in this process be to just try to work through you guys, and have you help these folks? Because it sounds like they need a lot of assistance just getting to the application stage.

Nancy Santiago: Agreed. For me, I’d say it’s not just getting help to us. We’re part of a larger pipeline of help. I would say, the first thing is coming to us to help you know, what’s the documentation that you need? Let us list that for you. Let us give you some resources where you almost have your own checklist. Let us help walk you through what some of the financial documentation is it’s going to be required, and why and how you get to it. That’s part one.

Then we’ll have those resources available for you. We’re also offering free mentor sessions for anybody who is interested, so that they can not only go through the webinar, gets the resources in terms of written materials that they need, that they can review later on their own, but also have that mentor help you through it.

All of that is really to get you ready to then go to our partners like CDFIs, and community credit unions, that are also CDFIs many of them, getting you to be best prepared to when you get to them. I’ve now created the capacity for that team on the other side to do their work faster, because it’s all time consuming. The more well-prepared you are when you walk in to the lending institution, the faster they can move, and the more people they can serve. Think about this as a pipeline, and each of us has our role to play in this. Ours is really trying to help entrepreneurs know what they need to have in hand to walk into those lending institutions ready to go.

Brent Leary: Because it is two week window?

Nancy Santiago: That’s what we’re hoping for. Again, devil’s in the detail. How well we get people ready, and how fast we get them to the right institutions to move this. But it’s absolutely correct. But that’s where the problem with the previously existing relationships came in. Because if you had that existing relationship with a bank, you probably could access at top levels what was available. Without that relationship, that doesn’t happen. Then you’re left. It’s like a lottery, good luck.

Will Real SMBs Benefit This Time Around?

Brent Leary: I remember hearing about like, Ruth’s Chris Steakhouse got $20 million. The Lakers got three, or $5 million. Have all those things been worked out? Do you think that this money is finally going to go to the people who actually need it to survive, and not the folks who are really good at filling out applications that have the right friends in the right places?

Nancy Santiago: I try to have a little faith. I try. I have a good friend who used to say perception is reality, six days of the week, except for Sundays, where we try to have a little faith. I have a little faith and say, A, we’ve learned from the first rounds of this, what went wrong, and we’ve tried to make adjustments. B, we have more people paying attention to those things that went wrong, and watching for it now. C, we’ve engaged a whole new core of partners that have in their mission and in their focus, the communities that have been the most left out. I’m hoping that those things, and mixed with a little faith here, get us to a better place at how we roll this out.

This was a better start. Acknowledging that there was an entire community of SMBs that were left out of this, was the first conversation that we needed to have. Acknowledging it, recognizing it, and trying to adjust for it. Look, the truth of the matter is, none of us have been here before.

Again, trying benefit of the doubt here, none of us had been here before. When it comes to the pandemic, and the impact the pandemic is having on the economy, it could be argued that those black and Brown small business owners haven’t been in the capital access problem before, because this has been a historical problem. But when it comes to how we roll these things out, there’s a lot that we’ve learned in the first go around with this one.

I’m hoping that we learned enough, and we have the right leadership in place to help make sure we do a better job of it this time. I’m hopeful with the signs that I’m seeing around paying attention to communities of color, communities that have been left out, women entrepreneurs, black, Latino, indigenous entrepreneurs, all those folks that we know just disappeared off the radar screen in the first tronches of this, the first rollout.

Brent Leary: Could you tell us what numbers people can expect, or are hopeful to get when it comes to this process?

Nancy Santiago: I’ll say that we found that on average, in the first roll outs of this, what people were asking for was on average about $5,000. That’s not a lot of money. It’s really not. Now, obviously, you have your Ruth, Chris’s steakhouse houses of the world, and then you have others. But if you think about what the average amount was that folks were looking to get, or that folks were giving grants for, it was about the $5,000 more.

That could change. Now we could see different numbers because we’ve opened it up differently to another community, and created more access routes. We’ll see, that’s what the average was. I’m pulling that number based on some data that came from one of our philanthropic partners. When we rolled out yet another grant program with google.org, and Hispanics and philanthropy, we looked at that $5,000 number and said, we’re going to stick with that number as what the grant amounts should be, but we’re going to make sure that we distinct it, so people get that plus, in terms of services that we can provide them. So another $5,000 and more of more in kind services related to coaching, mentoring, and strategic support.

Moment or Movement – Equality and Inclusion

Brent Leary: We’re a year into this now. Where are we with that? Are we seeing beyond the initial promises? Are we seeing things starting to move in the right direction? Things starting to come together around this?

Nancy Santiago: I will say that I have seen a lot of really good intentions, and folks trying to dig in. But like everything else, there’s such a short life cycle that we’ve seen around these important topics, that it’s not enough for that moment of a pledge. You have to embed this conversation into everything that you do as an entity, if you really want to make a difference.

If you really want to make a dent in the racial equity wealth gap that this country has, then it can’t just be the one pledge. How are you embedding the conversation of the race-based wealth gap into everything that you do as a company? And how are you centering, and focusing your work on justice, and racial equity issues? That’s harder for folks. I absolutely appreciate the funds, and the pledges, and the commitments because it was honestly, a long time coming.

This is stuff that should have been happening anyway. Glad folks stepped up, absolutely thankful for it. But if we take our eyes off the ball, and we don’t make this part of our everyday mission critical work, then it will go right back to what we’ve always been to. We can’t go back to normal. Normal was not equitable, normal was not fair, and normal is what allowed our communities to be impacted so differently by this pandemic. So, we can’t go back to normal.

To really be able to make a sustained difference, it now needs to become part of the mission of what you do. Must be focused on justice, and racial equity, and gender equity at its core. The dollars again, I keep saying this, dollars are nice systemic changes, nicer.

Do I see some pieces of that happening? Absolutely. I see more and more people paying attention to black and Brown led funds. I see more people paying attention to that minority business owner in general. I see that conversation, I see some energy around it, and that has been sustained. Now the question is, can we ever get the resources that match the need? That was tricking all this. This is not a problem that appeared this year. What was going to happen this year has been generations in the making.

This article, “Nancy Santiago of Ureeka: Changes to PPP Should Help More Black and Brown Small Businesses Get Assistance This Time Around” was first published on Small Business Trends