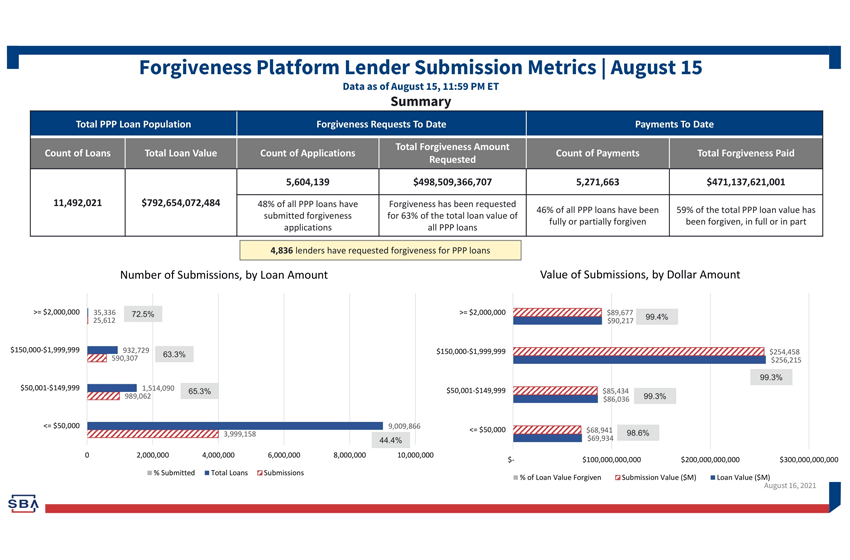

Overall, 52% of small businesses haven’t asked for PPP loan forgiveness. This is from the combined number of applicants in 2020 and 2021 as of August 15, 2021. And as the time for the first payment fast approaches for the loan recipients, this is a timely reminder to quickly apply for PPP loan forgiveness.

The Small Business Administration’s PPP Loan Forgiveness Portal makes that easier than ever if you have applied for a loan that is less than $150,000. If the loan is higher, you have to take the standard route with your lender.

52% Haven’t Asked for PPP Loan Forgiveness

According to the Small Business Administration (SBA) weekly summary, 48% of all PPP loans have submitted forgiveness applications. This includes the submissions for 2020 and 2021 for a total of 5,604,139 applicants. And to date, 46% of all PPP loans have been fully or partially forgiven for a total of $471.137 billion.

With a total of 11,492,021 loans with a value of $792.654 billion more, small businesses have the opportunity to have their loans forgiven. The breakdown for 2020 and 2021 are as follows:

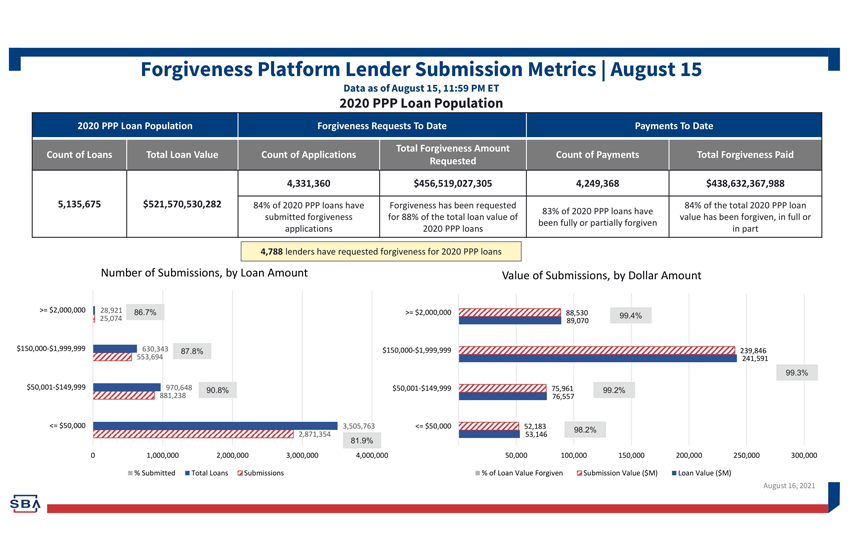

PPP Loans in 2020

In 2020 there were a total of 5,135,675 loans with a value of $521.570 billion. To date (August 15) 84% of the applicants or 4,331,360 have submitted forgiveness applications. And almost all or 83% of the 2020 PPP loans have been fully or partially forgiven. This brings the total value of the forgiven loan to $438.632 billion from the requested $456.519 billion.

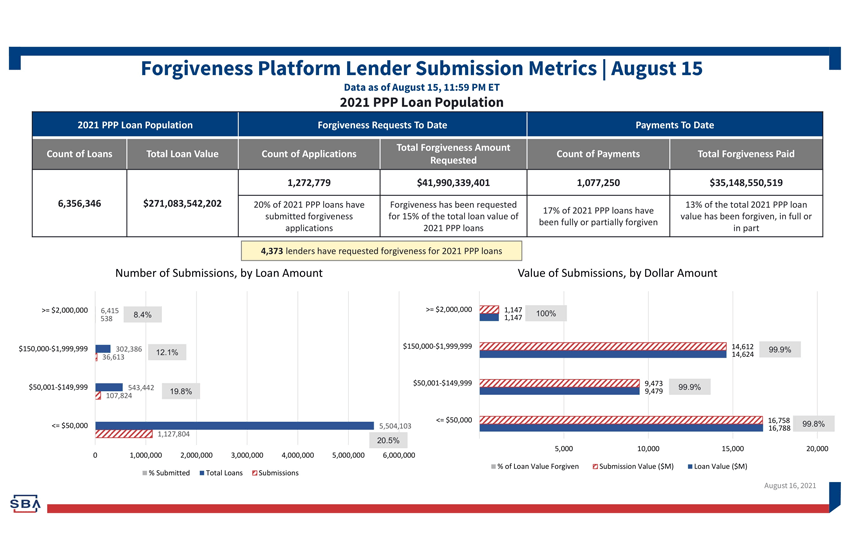

Second Draw PPP Loans in 2021

In 2021, there were 6,356,346 loans awarded worth $271.083 billion. And as of August 15, 1,272,779 or 20% of the applicants have applied for the loan forgiveness. The forgiveness amount they requested comes out to $41.99 billion or 15% of the total loan value for 2021.

So far, 17% of the PPP loans have been fully or partially forgiven, bringing the total of the paid forgiveness to $35.148 billion or 13% of the total 2021 loans.

High Forgiveness Rates on PPP Loans

The data shows there is a very high forgiveness rate when small businesses apply. The discrepancy between 2020 and 2021 is the timing of the loan. Once a business is approved for the loan and you get the funds deposited in your account, you have anywhere between eight and 24 weeks of the covered period.

After your covered period ends, you have 10 months before the lender requires payment. And you can apply anytime within this period for the loan forgiveness. That means businesses that applied in 2021 are still in that 10-month period. Again, it is worth mentioning you don’t have to wait until the 10 months is over. As a matter of fact, it is best to start the process early because there is a total of 150 days for lenders and the SBA to evaluate the applications.

With the uncertainty of the economy, as a small business owner, you must submit your forgiveness request before you start making payments on your PPP loan. You can get more information about the PPP loan with a thorough FAQ, and if you are looking for more funding options, take a look at SBA grants for underserved communities.

Take a look at the rest of the forgiveness data from the SBA below:

Images: SBA, Depositphotos

This article, “52% of Small Businesses Haven’t Asked for PPP Loan Forgiveness” was first published on Small Business Trends