Did you know that you can buy a large truck, SUV or other vehicle for your business, and be able to write off 100% of the purchase price as a tax deduction, according to IRS rules? If you’re reading this before December 31st, there’s still time to take advantage of this rule for the 2020 tax year.

Small businesses can deduct the full purchase price of a business vehicle if it has a weight rating of over 6,000 pounds. Weight is based on an industry figure called Gross Vehicle Weight Rating (GVWR).

If the vehicle qualifies for a full deduction, you do not have to depreciate it (i.e., spread out the deduction) over a period of years. You get the value of the full deduction all in one year — a considerable tax savings.

This rule used to be called the Hummer Loophole, which Congress technically eliminated years ago. However, the Tax Cuts and Jobs Act of 2017 brought back a version of the Hummer Loophole starting in 2018. To take advantage of the 100% deduction, you have to apply the rules about Section 179 expensing, together with Section 168 Bonus Depreciation rules, to get to the 100% deductibility.

Criteria to Qualify

To take advantage of the deduction for the 2020 tax year, there are three main criteria:

- Buy before December 31, 2020: The vehicle must be purchased and placed into service during 2020, i.e., no later than December 31, 2020.

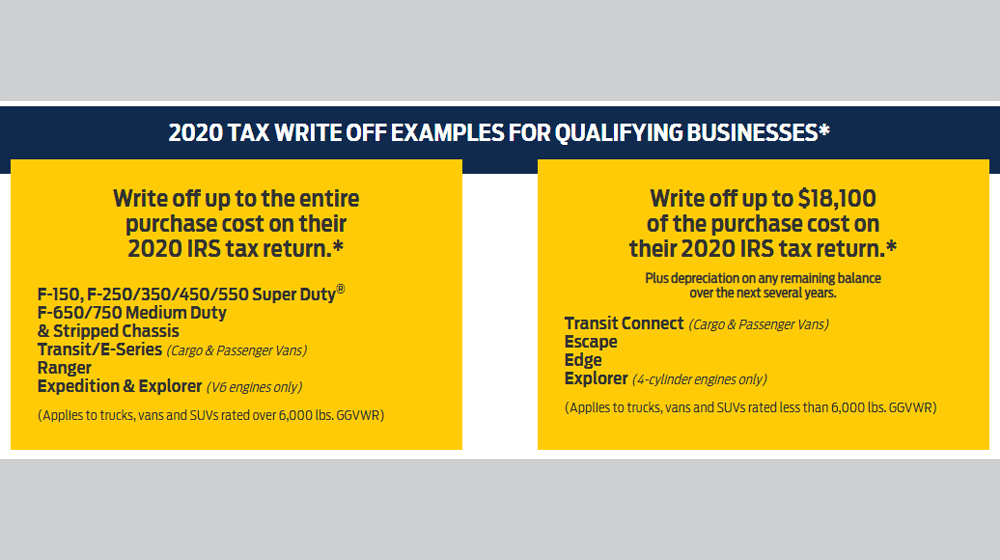

- GVWR rating of over 6,000 pounds: A business vehicle such as a large pickup truck, cargo van or large SUV, having a GVWR of over 6,000, may qualify for the 100% deduction. In North America this weight rating must be labeled on the inside of the driver door, near the latch. Various option packages can affect a model’s GVWR so make sure to check the label of the actual vehicle you are buying. See the chart below for a partial list of qualifying vehicles based on weight.

- Business purpose: If you plan to use the vehicle partially for personal purposes, it must be used at least 50% for business. However, if it is for partial personal use, you can only deduct the percentage used for business. Multiply the purchase price by the percent of business use (51% to 100%).

What About Light Trucks and Cars?

Business vehicles rated 6,000 pounds or below still get a write-off. However, the deduction for the 2020 tax year for lighter vehicles is limited to the first $18,100.

Any portion of the purchase price over and above $18,100 must be depreciated over a period of years per IRS depreciation rules.

What’s this Tax Break Worth?

Saying that you can deduct the full amount does not mean you deduct the purchase price amount dollar for dollar from your income tax liability. Rather, you need to know your tax bracket. You multiply the amount of the purchase price by your marginal rate to find the value of the tax break.

Example: if the purchase price of a heavy truck is $95,000, and you are in the 24% tax bracket, to get a back-of-the-envelope figure for the value of your write-off, you multiply 95,000 x .24 = 22,800. Your deduction could reduce your taxes by $22,800 for 2020. Not bad!

On top of the Section 179 and Bonus Depreciation deductions, remember that you can also deduct mileage costs for operating the vehicle. See 2020 IRS mileage rates.

Also, see: Top Small Business Tax Deductions.

Like all tax rules, there are a number of exceptions and exclusions, so check with your tax advisor about your situation and any limitations.

List of Heavy Trucks and SUVs That Qualify

Audi

- Audi Q7, SQ7

- Audi Q8, SQ8

BMW

- BMW X5 M

- BMW X5 XDrive35I

- BMW X6 M

- BMW X6 XDrive35I

- BMW X7 (all models)

Bentley

- Bentley Bentayga

Buick

- Buick Enclave 2WD

- Buick Enclave 4WD

Cadillac

- Cadillac Escalade 2WD

- Cadillac Escalade AWD

- Cadillac XT5

- Cadillac XT6

Chevrolet

- Colorado 2.8L AWD

- Silverado C1500

- Silverado C2500

- Silverado C3500

- Silverado K1500

- Silverado K2500

- Silverado K3500

- Suburban C1500

- Suburban K1500

- Blazer

- Tahoe 2WD LS

- Tahoe 4WD LS

- Tahoe Hybrid

- Traverse 2WD

- Traverse 4WD

Chrysler

- Chrysler Pacifica

- Chrysler Pacifica Hybrid

Dodge

- Dodge Durango 2WD

- Dodge Durango 4WD

- Dodge Grand Caravan

Ford

- Ford Expedition 2WD

- Ford Expedition 4WD

- Ford Explorer 2WD

- Ford Explorer 4WD

- Ford F-150 and larger 2WD

- Ford F-150 and larger 4WD

- Ford Flex AWD

GMC

- GMC Acadia 2WD

- GMC Acadia 4WD

- GMC Sierra C1500

- GMC Sierra C2500 HD

- GMC Sierra C3500 HD

- GMC Sierra C3500 HD

- GMC Sierra K1500

- GMC Sierra K2500 HD

- GMC Sierra K3500 HD

- GMC Yukon 2WD

- GMC Yukon 4WD

- GMC Yukon Hybrid

- GMC Yukon XL C1500

- GMC Yukon XL K1500

Honda

- Pilot 4WD

- Honda Odyssey

- Honda Ridgline AWD

Infiniti

- Infiniti QX80

- Infiniti QX56

Jeep

- Jeep Grand Cherokee

- Jeep Gladiator Rubicon

Land Rover

- Range Rover 4WD

- Range Rover SPT

- Discovery

- Defender

Lexus

- Lexus GX460

- Lexus LX570

Lincoln

- Lincoln MKT AWD

- Lincoln Navigator

- Lincoln Aviator

Mercedes Benz

- Mercedes-Benz G550

- Mercedes-Benz GLS

- Mercedes-Benz GLE

- Mercedes-Benz Metris & Sprinter

Nissan

- Nissan Armada 2WD

- Nissan Armada 4WD

- Nissan NV 1500 S V6

- Nissan NVP 3500 S V6

- Nissan Titan 2WD S

Porsche

- Porsche Cayenne

Ram

- Ram Promaster 1500-3500

- Ram 1500 and up

Subaru

- Subaru Ascent

Tesla

- Tesla Model X

Toyota

- Toyota 4Runner 2WD LTD

- Toyota 4Runner 4WD LTD

- Toyota Landcruiser

- Toyota Sequoia 2WD LTD

- Toyota Sequoia 4WD LTD

- Toyota Tundra 2WD

- Toyota Tundra 4WD

This article, “Buy a Truck or SUV Before Year End, Get a Tax Break” was first published on Small Business Trends