If you run a business, you may have heard of Venmo, the mobile payment app that allows users to quickly and easily send and receive money. While Venmo is often thought of as a tool for friends and family to split expenses, it can also be used for business transactions. Keep reading to discover the essentials of using Venmo for business financial transactions to understand how it can streamline your payment process and improve your bottom line.

What is Venmo?

Venmo is a mobile-first financial platform designed to facilitate peer-to-peer (P2P) money transfers with ease. Also, importantly, it’s an extremely cheap way to send money. Serving as a digital wallet, Venmo offers users a simple, affordable, and convenient method to send, receive, and request money without the traditional use of cash or checks. With Venmo for business, you can process payments faster and more securely while avoiding extra fees and complicated processes.

Here’s an in-depth look:

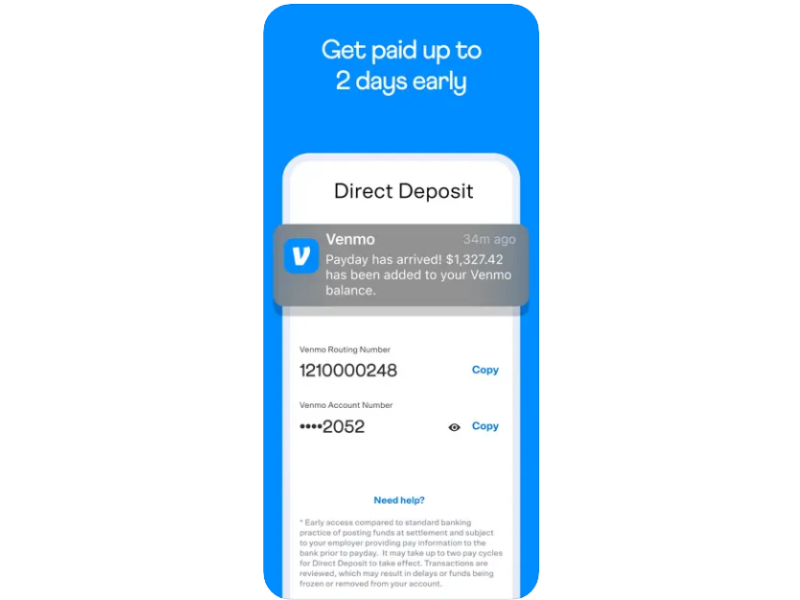

- Digital Wallet: Beyond just a transaction tool, Venmo allows users to store funds within the app, which can be used for future transactions or transferred to a linked bank account.

- User-Centric Design: Venmo’s interface is user-friendly, ensuring that even those who aren’t tech-savvy can navigate and perform transactions without hurdles.

- Fast and Secure: Transactions on Venmo are almost instantaneous, and the platform employs multiple layers of security measures to safeguard user information and funds.

- Social Features: One unique aspect of Venmo is its integration of social features. Users can share their payment activities (excluding the amount) with their friends, making it a more interactive experience compared to traditional banking apps.

- Mobile Accessibility: With the Venmo mobile app, users can execute transactions anytime, anywhere, right from their phones, eliminating the need for physical bank visits or ATM withdrawals.

- Venmo for Business: Businesses can leverage Venmo to streamline their payment processes. With this feature, companies can accept payments directly from customers through Venmo, ensuring quick processing while sidestepping many of the additional fees that other payment processors might impose. Moreover, with its vast user base, businesses using Venmo can tap into a younger demographic that prefers digital payment methods.

Here’s a Venmo Full Tutorial for Beginners 2023 from TruFinancials you’ll want to check out after reading:

Is there a Difference Between a Personal Venmo Account and Venmo for Business?

Yes, personal accounts are meant for everyday transactions. They allow users to send, receive, and request money quickly and securely. Venmo for Business, on the other hand, is specifically designed to streamline commercial transactions.

It provides more advanced features like invoicing, payouts, employee reimbursement, payment links, and more. Both offer secure protection against fraud, but the features available with a business account make it more suitable for larger payments.

How Does Venmo for Business Work?

Venmo for Business allows merchants to set up an account and accept payments from customers via the Venmo app. Merchants can create invoices or send payment requests, and customers can pay with their Venmo balance, linked bank account, or debit/credit card.

Once payment is received, funds are typically available for transfer to the merchant’s bank account within one to three business days. Additional features include transaction history tracking, custom payment descriptions, and customer dispute resolution.

Venmo Business Fees

Venmo for Business has several fees that merchants should be aware of. The fees to accept Venmo payments include:

- Transaction fee: Venmo for Business provides businesses with an easy and secure way to process payments. It comes with a competitive transaction fee of 1.9% plus 10 cents per transaction, allowing businesses to accept payments without worrying about high fees.

- Credit card fee: Customers who choose to pay with a credit card will have to pay an additional fee of 3% of the transaction amount. This can be a potential drawback to businesses, especially those that rely on credit card payments from their customers.

- Standard transfer fee: Standard bank transfers with Venmo for Business are totally free, making it a cost-effective way for businesses to accept and transfer payments. Plus, these payments usually take one to three business days to complete, allowing businesses to plan their cash flow accordingly and make strategic decisions.

- Instant transfer fee: If merchants want to transfer funds to their bank instantly, Venmo charges a fee of 1.75% of the amount transferred, with a minimum fee of 25 cents and a maximum fee of $25. This fee can add up quickly over time.

Advantages of Using Venmo for Business

If you’re looking for a quick and easy way to accept payments for your small business, Venmo might be a great option. As a mobile payment service owned by PayPal, Venmo offers several benefits for businesses. In this section, we’ll explore five key advantages of using a business Venmo account.

Convenient Payment Processing

Venmo business accounts provide businesses with a quick and easy way to receive payments from customers in the form of mobile payments through their secure mobile app.

This payment option can save time and money for businesses as it is both fast and convenient, thus making it one of the most popular choices for businesses that need a hassle-free way to process payments.

Low Transaction Fees

Venmo for Business is a great option for businesses needing to process payments, as it has low transaction fees of only 1.9% plus 10 cents per transaction.

This makes it an especially attractive option if your business processes a high volume of transactions, as it won’t cost you too much in fees, allowing you to maximize your profits.

Furthermore, Venmo for Business also provides easy invoicing functionality and the ability to pay multiple people with one payment – both of which are incredibly useful features that can save time and effort when processing payments.

Bank Account Integration

Venmo for Business provides great flexibility when it comes to making payments and receiving funds, as it allows you to link your business bank account to the app.

This means that transactions can be processed quickly and easily, with funds transferring directly from your bank account into the Venmo platform.

The integration also makes it easy to track all of your payments, meaning that you can keep a close eye on your expenses and how much money is coming in.

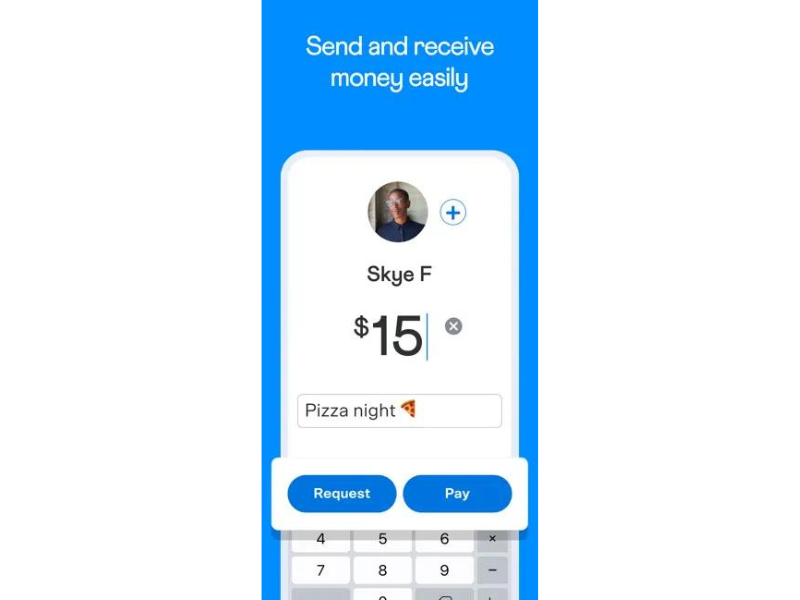

Venmo Payments

Venmo Payments make it incredibly easy for customers to send payments, as they can do so directly from their Venmo accounts.

This means that transactions are completed in a matter of minutes, and customers don’t have to waste time filling out forms, entering payment details, or waiting for payments to be processed.

Greater Customer Reach

By accepting payments through Venmo, businesses can open up their services and products to a much broader audience. This is because millions of people already have Venmo accounts, and being able to pay with the app makes the purchasing process more convenient for customers.

Moreover, by having Venmo as an option available at checkout, businesses are more likely to attract users who may not have heard about them otherwise. This can lead to greater sales opportunities for businesses and help them build up their customer base in the long run.

Disadvantages of Using Venmo for Business

While Venmo has several advantages for small businesses, it’s important to be aware of the potential downsides of a Venmo business account as well. Below are some of the key disadvantages to consider:

Limited Functionality for Business Use

Venmo is primarily designed for peer-to-peer transactions, which means it may not offer all the features and functionality that a business needs to manage payments effectively.

No Free Instant Transfers

Venmo charges a 1.75% fee for instant transfers, which can be a disadvantage for businesses that need to access their funds quickly.

Limited Payment Options

Venmo only accepts payments in USD and is meant for domestic transactions, which could be an issue if you do business with international customers.

Privacy Issues

Venmo has faced some privacy issues in the past, including a settlement with the Federal Trade Commission for misrepresenting its security practices and a public display of user transactions that led to concerns over data privacy.

How to Set Up Venmo for Business

As a business owner, you can use Venmo to accept payments from customers. Here’s how to set up Venmo for business step-by-step on the web:

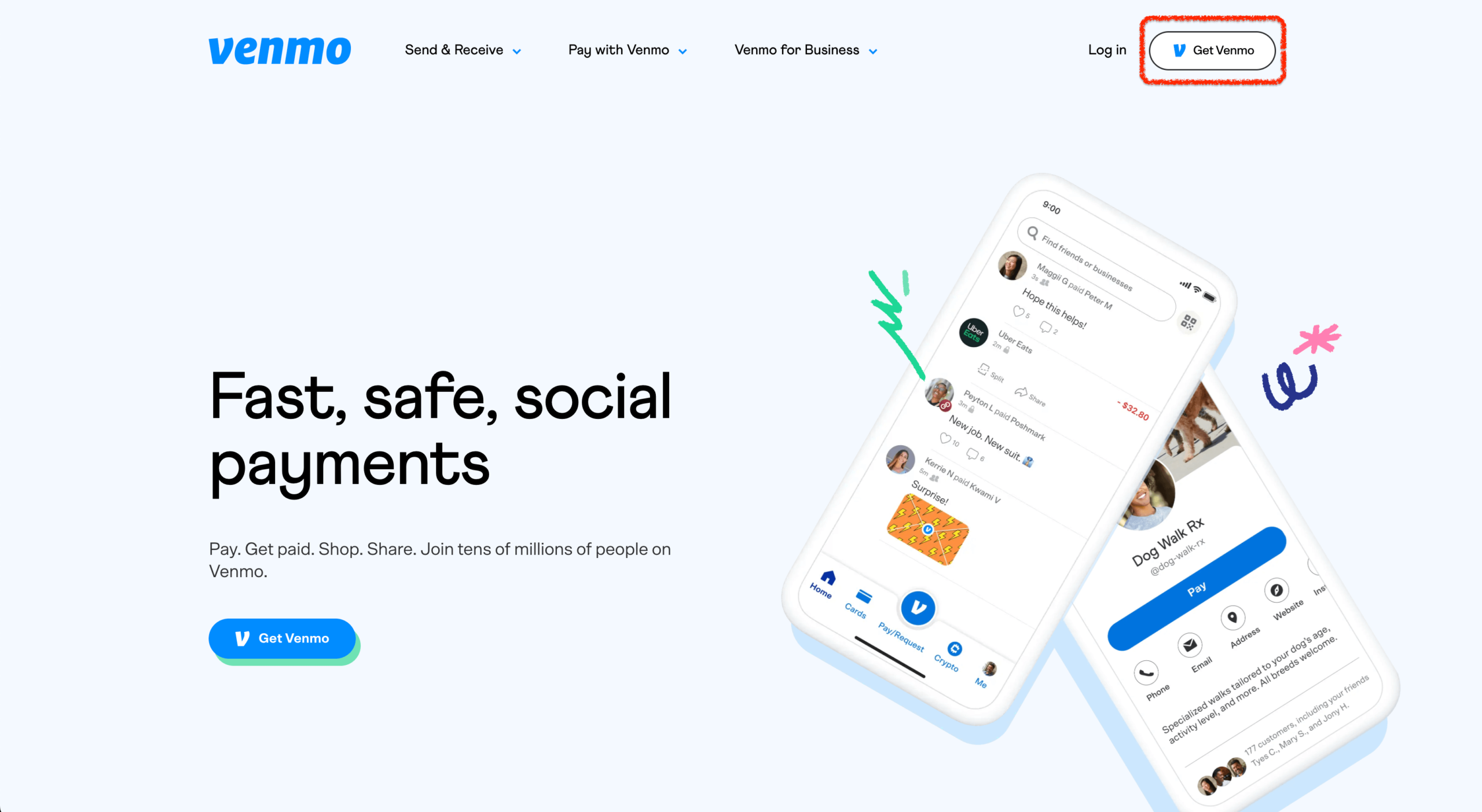

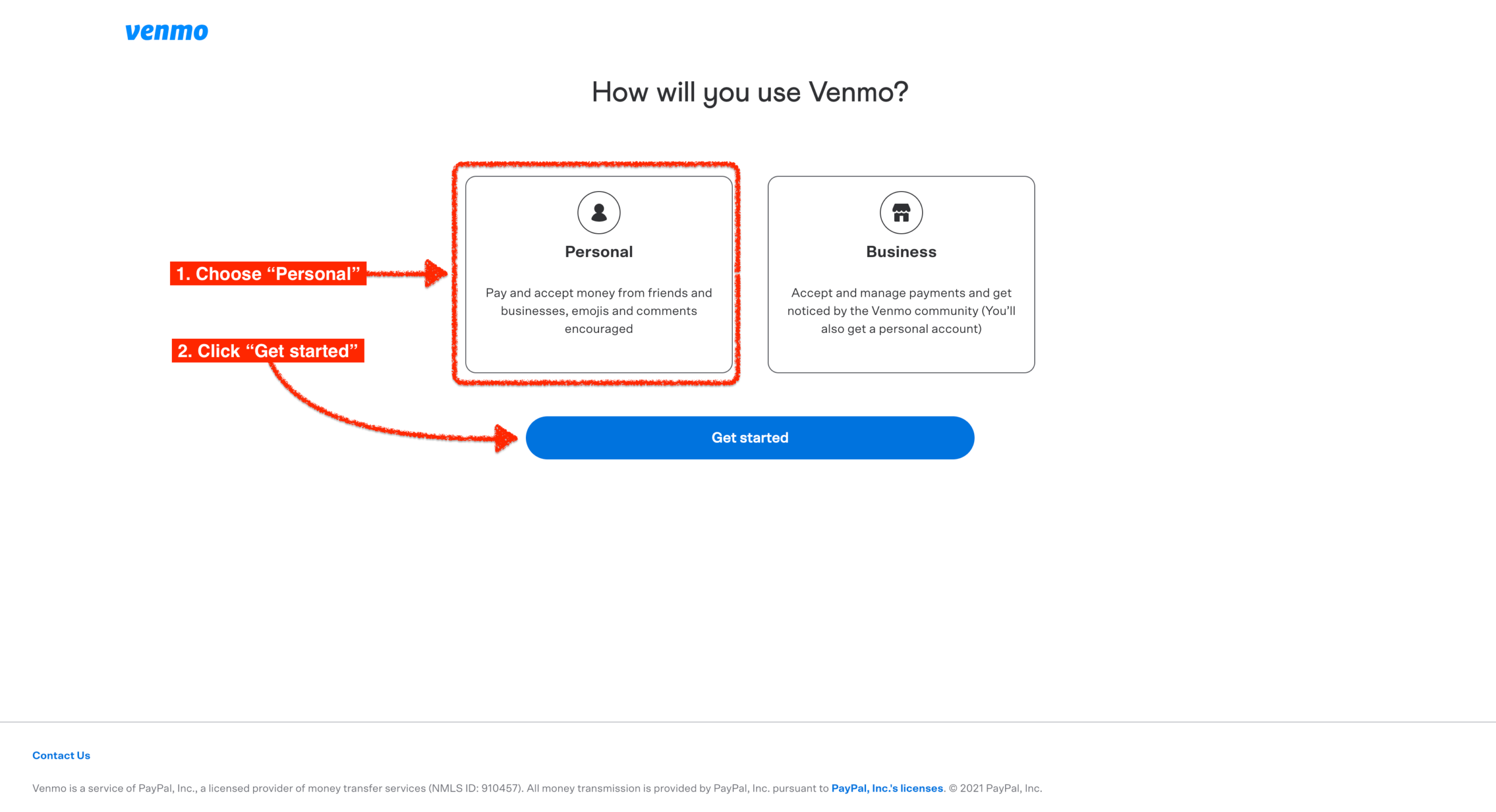

Step 1: Log in or Sign Up for a Personal Venmo Account

If you already have a personal account on Venmo, simply log in and move on to the next step. If you don’t, go to Venmo.com and click on “Get Venmo” at the top right of your screen.

You can choose to set up a personal or business account when you signup.

Since Venmo makes it super easy to switch back and forth between these two types of accounts, it makes sense to set your account up as personal and add a business profile to it as described in step two below.

After your personal account is set up and activated, move on to the next step.

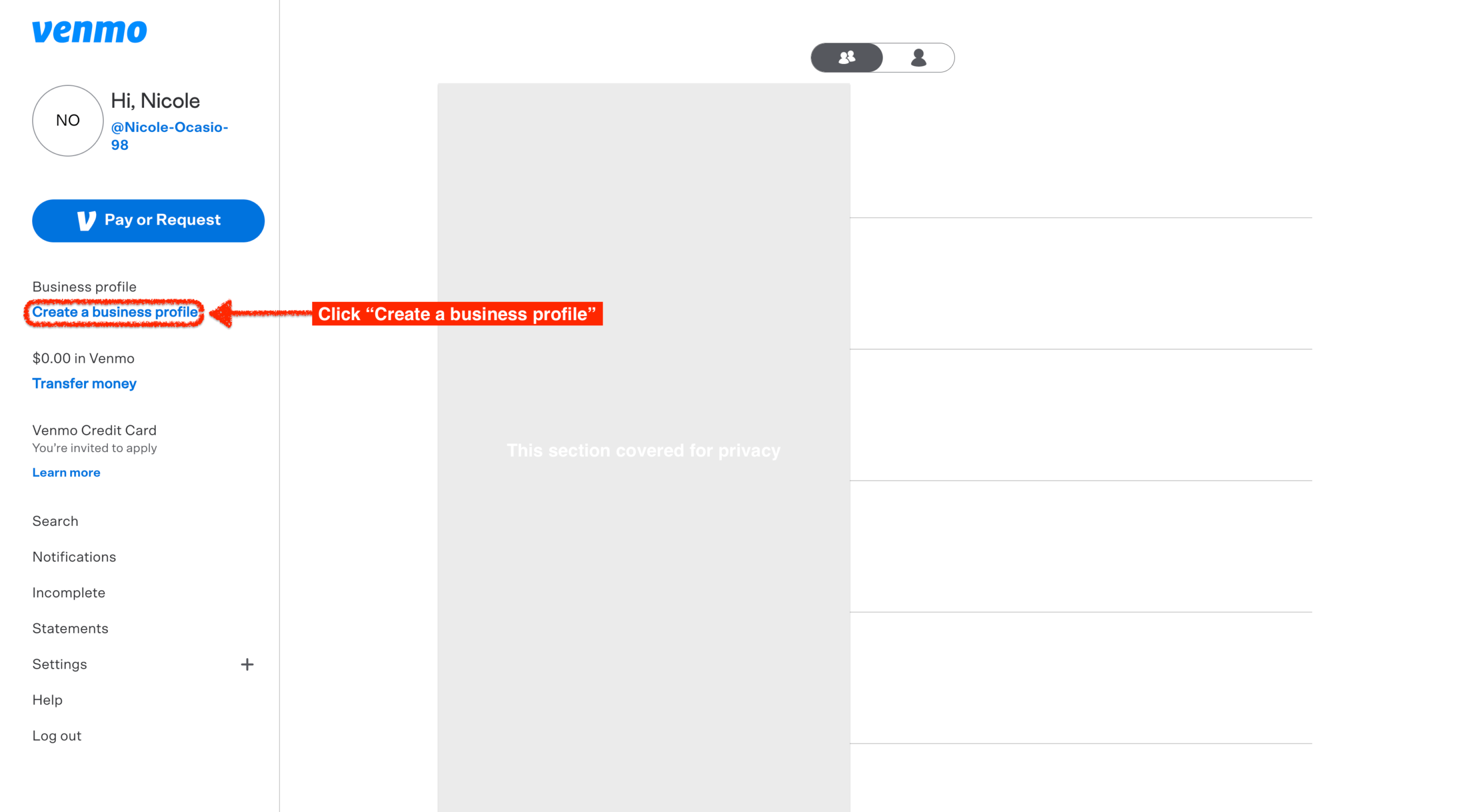

Step 2: Create a Business Profile

From within your personal Venmo account, click on “Create a business profile” on the left margin.

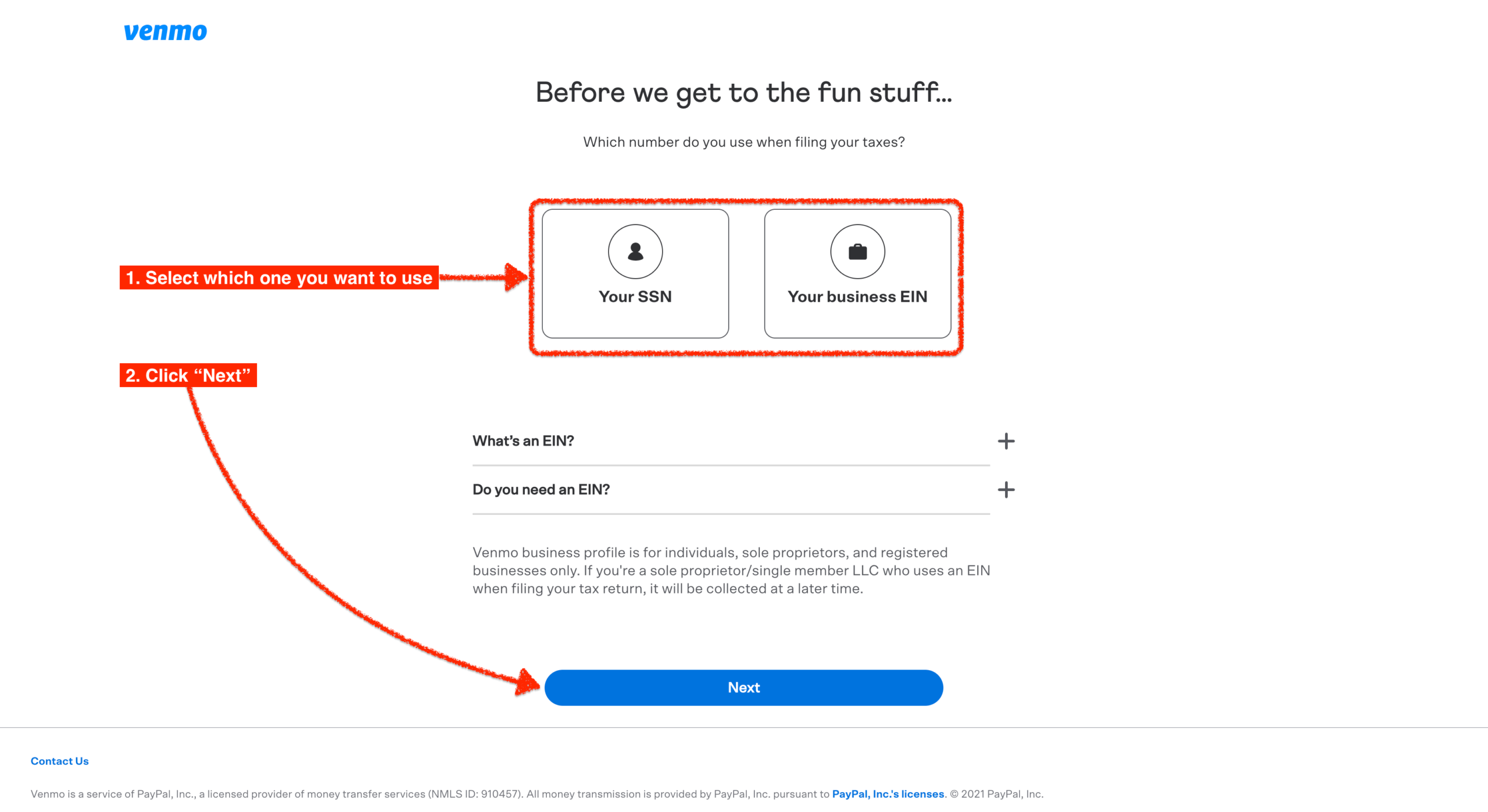

Select which number you’d like to use for tax purposes. You can use your social security number (SSN) or employer identification number (EIN). After making your selection, click “Next.”

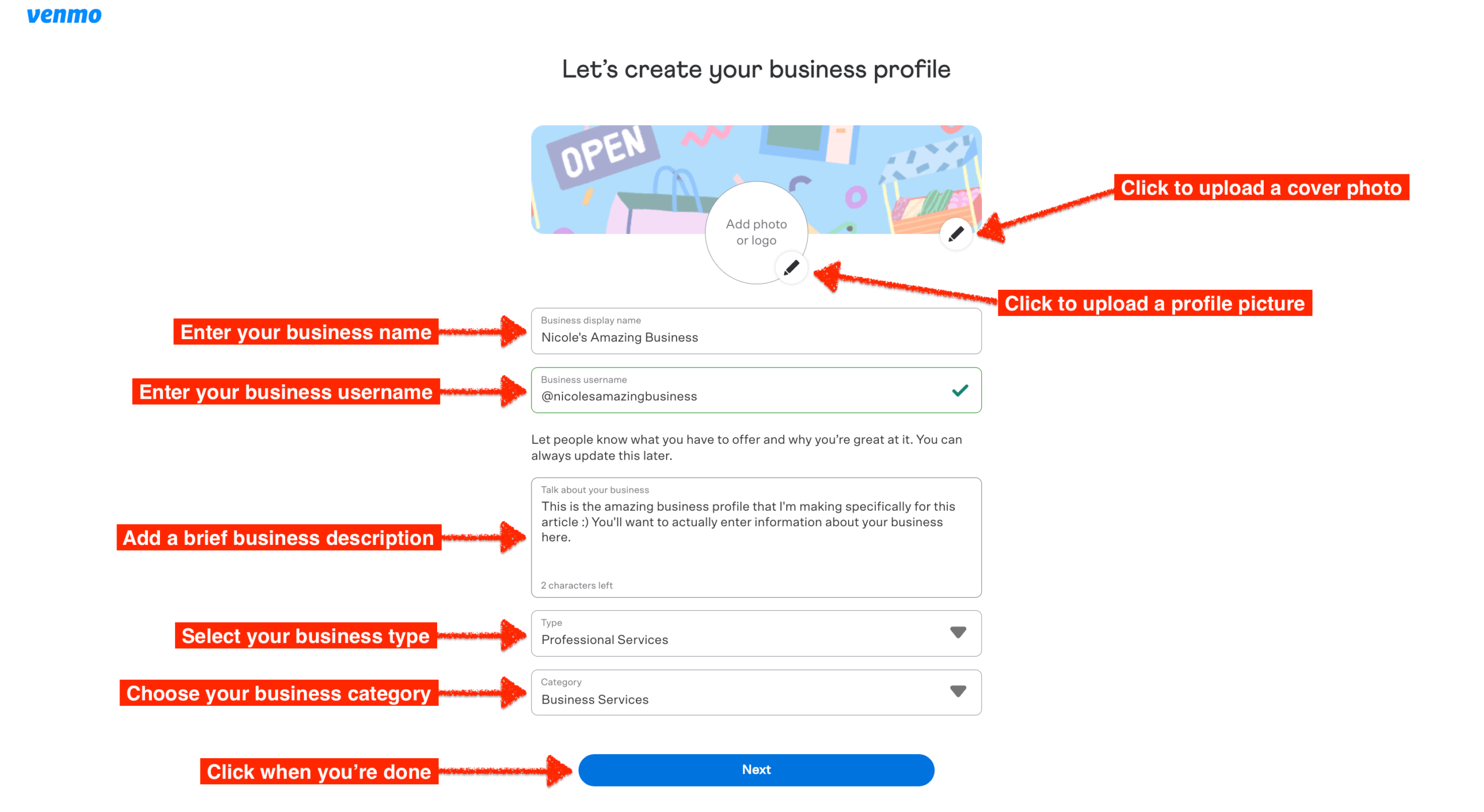

Step 3: Customize Your Business Profile

Now it’s time to customize your business profile. You can upload both a profile picture and a cover photo by clicking the little pencil next to each as shown in the screenshot below.

On this page, you can also enter your business name and your desired business username, talk a bit about your business, select your business type, and choose a category. When you’ve modified your profile to your liking, click “Next.”

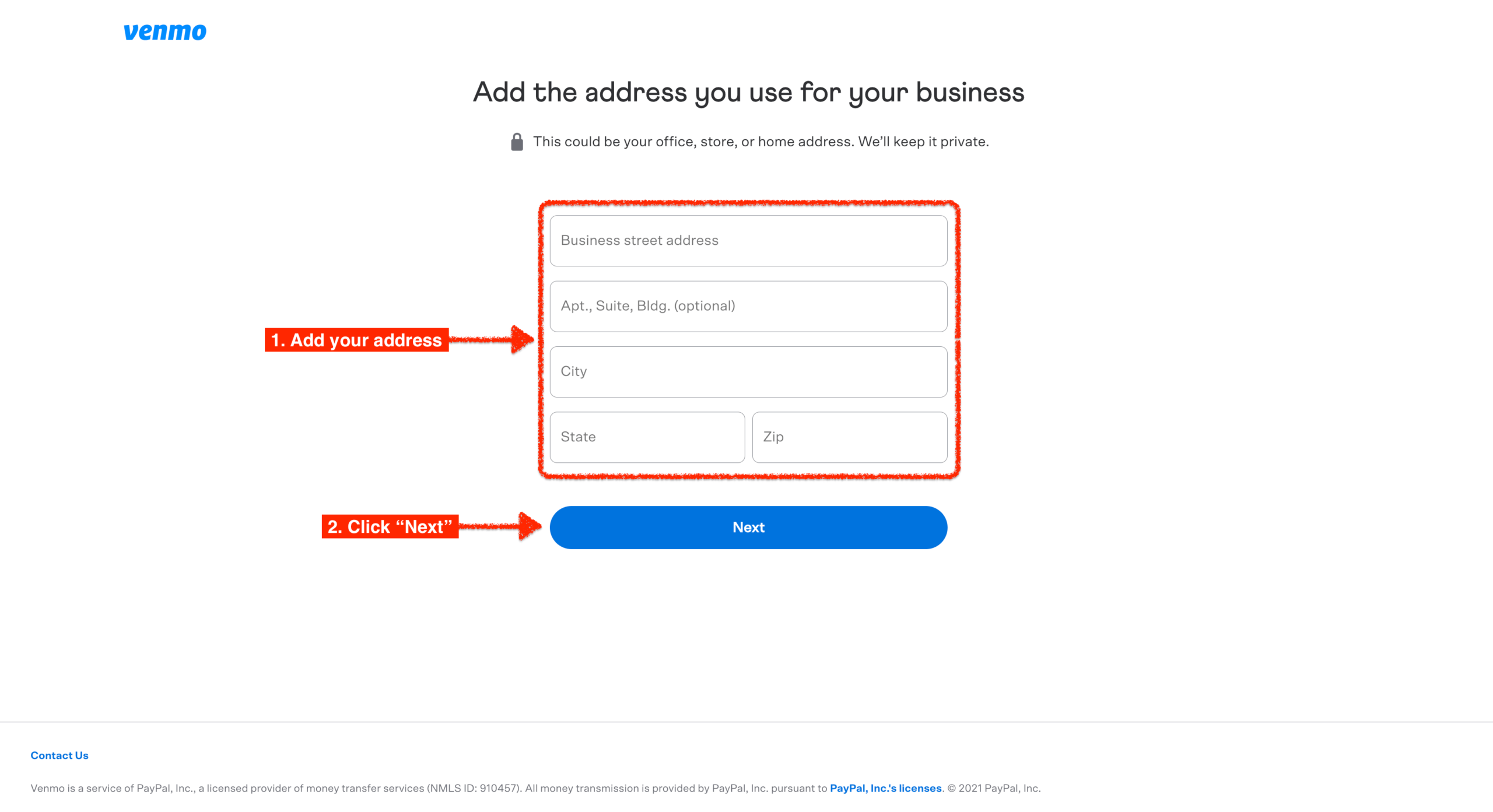

Step 4: Add Your Business Address

Add your office, store, or home address in the fields provided, which will be kept private.

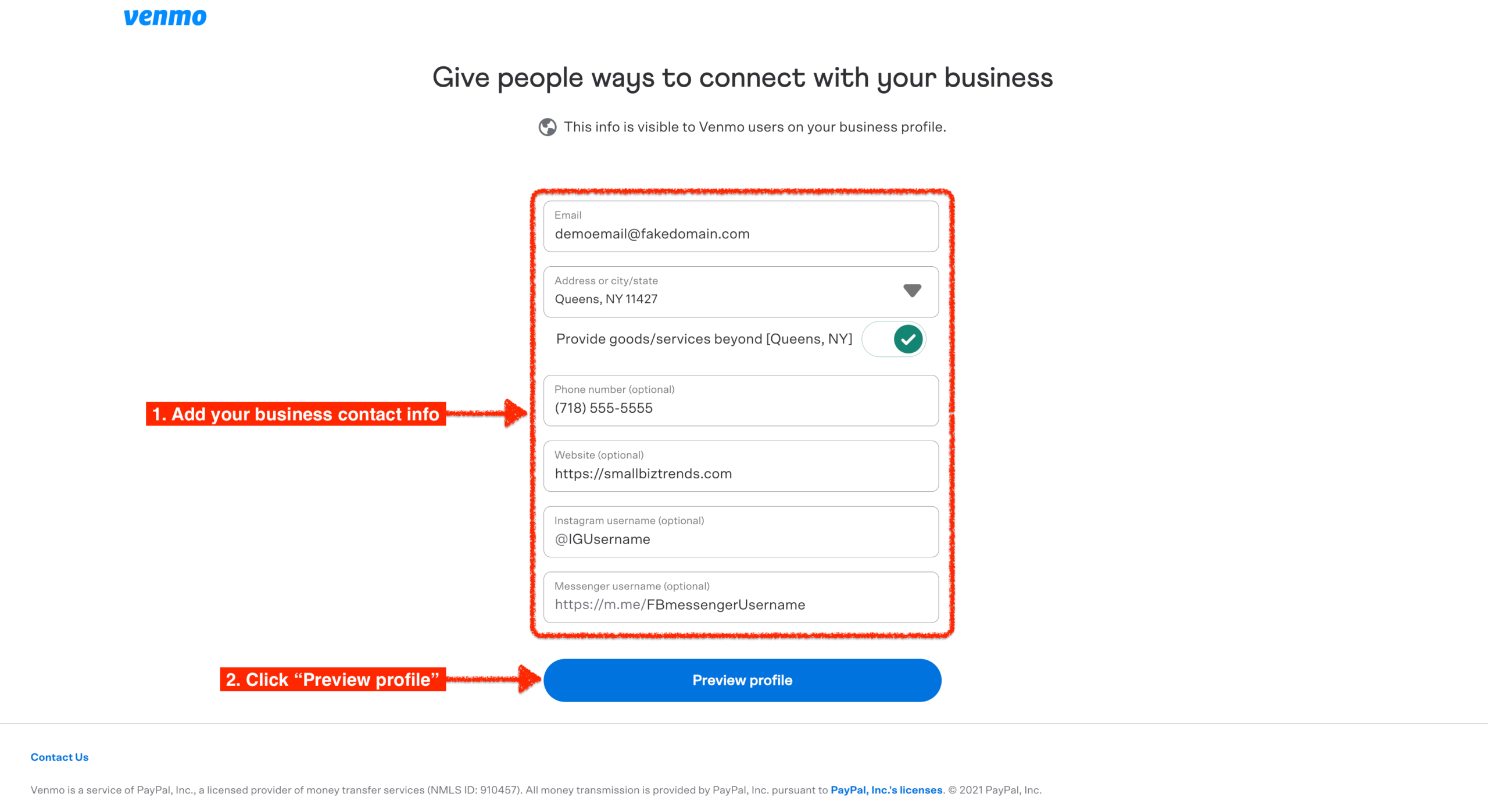

Step 5: Add Ways to Connect

On this page, you can add ways for people to connect with your business. You can add your email, address, phone number, website, Instagram username, and Messenger username. This info will be visible to other Venmo users on your business profile, so keep this in mind when adding contact information to this page. Click “Preview profile” when you’re done.

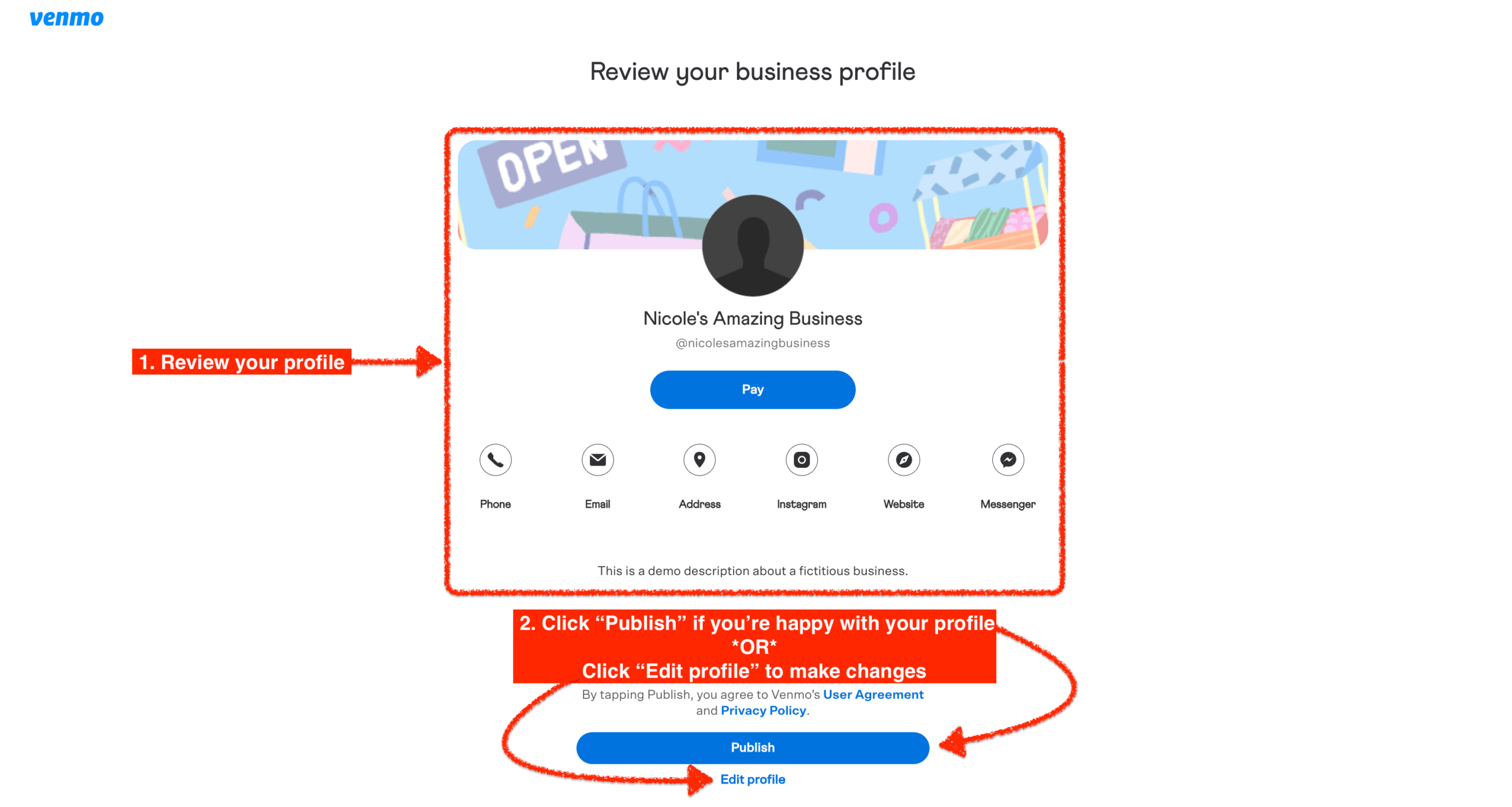

Step 6: Publish Your Business Profile

If you’re happy with how your Venmo business profile came out, then click “Publish.” However, if you need to make any changes before your profile goes live, click the “Edit profile” link.

Here is a table with abridged information (no screenshots) for quick reference:

| Step No. | Step Description | Details and Actions |

|---|---|---|

| 1 | Log in or Sign Up for a Personal Venmo Account | If existing user, log in. New users, visit Venmo.com and click “Get Venmo”. Set up a personal account and activate it. |

| 2 | Create a Business Profile | In your personal Venmo account, click “Create a business profile”. Choose SSN or EIN for tax purposes and click “Next”. |

| 3 | Customize Your Business Profile | Upload profile and cover photos. Enter business name, username, description, business type, and category. Click “Next”. |

| 4 | Add Your Business Address | Provide your office, store, or home address. Privacy ensured. |

| 5 | Add Ways to Connect | Input email, address, phone number, website, Instagram, and Messenger usernames. This info will be visible to Venmo users. Click “Preview profile”. |

| 6 | Publish Your Business Profile | If satisfied with the profile, click “Publish”. To make changes, click “Edit profile”. |

Venmo Business Features

Venmo offers several business-specific features to help streamline transactions and make it easier for small business owners to get paid. Here are five of the key features available through Venmo for Business.

QR Code Payments

To make in-person payments easy, customers can scan your unique Venmo QR code. Your Venmo QR code can be accessed by tapping “Scan” and selecting “Venmo Me” at the bottom of your business profile home screen. You can also share your QR code through email, text messages, print, and more.

Enable Customer Tipping

You can enable or disable tipping for your business by accessing the “Tipping” option in your business profile’s Settings. Tips will be included in payment statements, and the “Tipping” option can also be found under “What’s next” on your business profile home page if you have not received any payments yet.

Separate Limits

Your business and personal profiles have separate payment and bank transfer limits. Separate payment and bank transfer limits for business and personal profiles have benefits in terms of tracking expenses and transactions, minimizing confusion and errors, and maintaining accurate records.

Balance Transfers

Verified Venmo users can transfer their balance between personal and business accounts with ease. Transfers are available within moments, and there are no limits to the amount or frequency of transfers between profiles.

However, it’s important to note that transfers may be subject to review and may result in delays or funds being frozen or removed from the Venmo account.

Easy Customer Refunds

Refunds can be made with ease through the Venmo app, which will automatically associate the refund with the original payment allowing for effortless accounting. This refund will also appear as a separate line item in both your Transactions and statement.

Venmo Alternatives

Looking for an alternative to Venmo? There are several payment apps that offer similar features that are worth considering. Here are three amazing Venmo alternatives:

PayPal

PayPal offers flat-rate transaction fees, a variety of checkout integrations, subscription payments, seller protection, and customizable payment buttons. Venmo is for US transactions only while PayPal allows 25-currency payments.

Cash App

Cash App is a peer-to-peer payment app that integrates with Square, enabling direct payments. There’s no platform fee and instant bank transfers are free for businesses. Chargeback protection and no chargeback fees are also included.

Stripe

Stripe is a payment processor that makes it easy for sellers to accept payments. It’s secure, fast, and reliable, so you don’t have to worry about any issues arising. It’s integrated with a variety of platforms and offers features such as fraud detection.

Final Words

Using Venmo for Business is a great way to ensure quick, secure payments for customers. It’s important to familiarize yourself with the Venmo tax and $600 threshold rule and understand how they might impact you.

Be aware of 1099 rules, as well as other payment processors like PayPal. Alternatives like Cash App or Stripe are other processors that may offer different features businesses may need. Also, be sure to check out the Venmo Small Business Grand program.

Image: Depositphotos

This article, “Using Venmo for Business Financial Transactions: What You Need to Know” was first published on Small Business Trends