As followers of Sapient Insights Group know, we place a lot of emphasis on helping HR teams elevate the awareness of their work and their contributions to the business. Our annual research allows us to identify the HR practices, technologies and other factors that correlate to high business and talent outcomes—information that HR leaders can use to make an impact.

In this column, I will discuss what our research says about the latest trends in benefits strategies. But even more importantly, I will share how benefit offerings (and their delivery) can color how employees and business leaders perceive HR.

How to be viewed as strategic

When we analyzed research findings to determine the differences between strategic-focused and compliance-focused HR organizations, how HR approached benefits administration and delivery was among several differentiators.

One of the top five practices that correlated to a strategic perception of HR was the adoption of transformational leave and absence policies. On the other end of the spectrum, among the top five practices that marked an HR organization as compliance-focused was a reactive approach to employee health and wellness and the lack of mobile HR.

When you think about it, these findings aren’t surprising. An HR organization that takes the time to truly know its workforce and then aligns benefit offerings to unique employee needs and business goals will be viewed differently than one that relies strictly on standardized policies or waits to put programs in place after complaints pile up.

Every benefit offering should be reviewed periodically to ensure its relevance to employees and impact on the business. Leave and absence policies are a good example of benefit offerings that too often stay stagnant. Progressive companies are now building much more flexibility into time off, such as giving employees the ability to take partial days off, bank unused sick or vacation time and give sick days to colleagues, or relaxing the requirement for doctor’s excuses.

Time-off policies adaptable to the needs of various workforce demographics are highly correlated to employee satisfaction and retention. Remember the narrowly averted strike of railway workers in 2022? At the heart of the grievances was the number of sick days granted to workers and how they could be used. (One of the restrictions that stuck out in my mind was that workers couldn’t call in sick the day they were scheduled to work. So, too bad if you or your child woke up with a stomach virus on a workday morning.) The strike was averted when Congress imposed tentative contract agreements. The multiple unions representing the workers continued bargaining, and now, most workers do get paid sick days with much more flexibility in how they can be used.

Benefits strategies, adoption and spending trends

Our latest research also showed that, while overall HR spending is decreasing, spending on benefits is actually increasing for every company size category. Traditional benefit offerings are seeing the greatest increases in adoption and spending, especially for SMB and mid-market organizations competing for top talent.

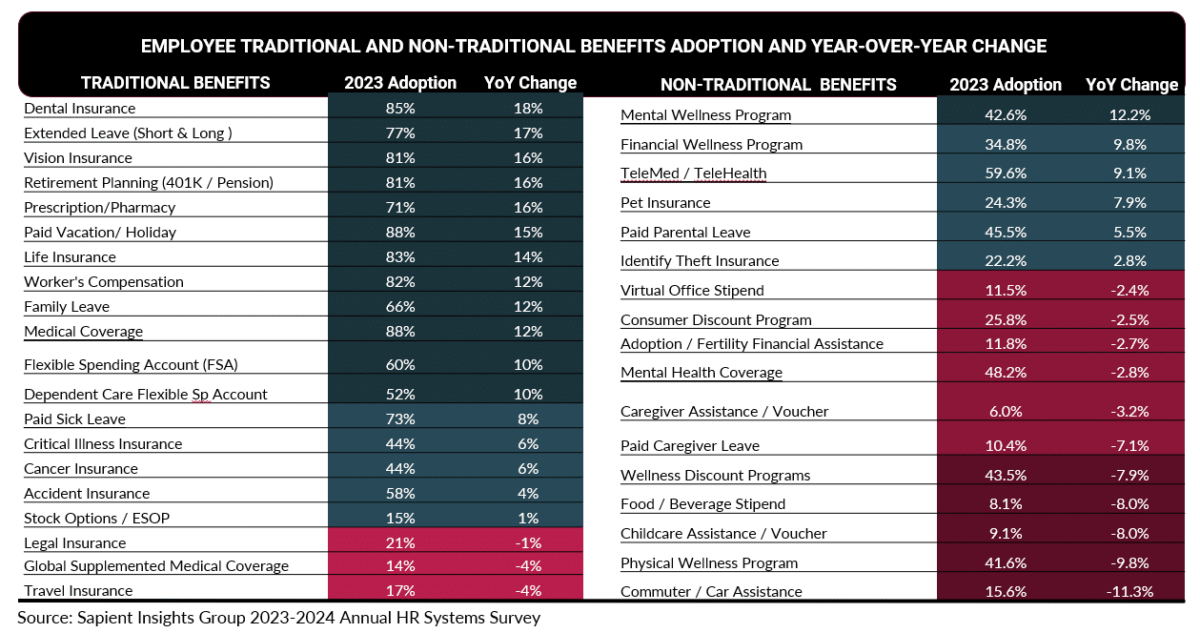

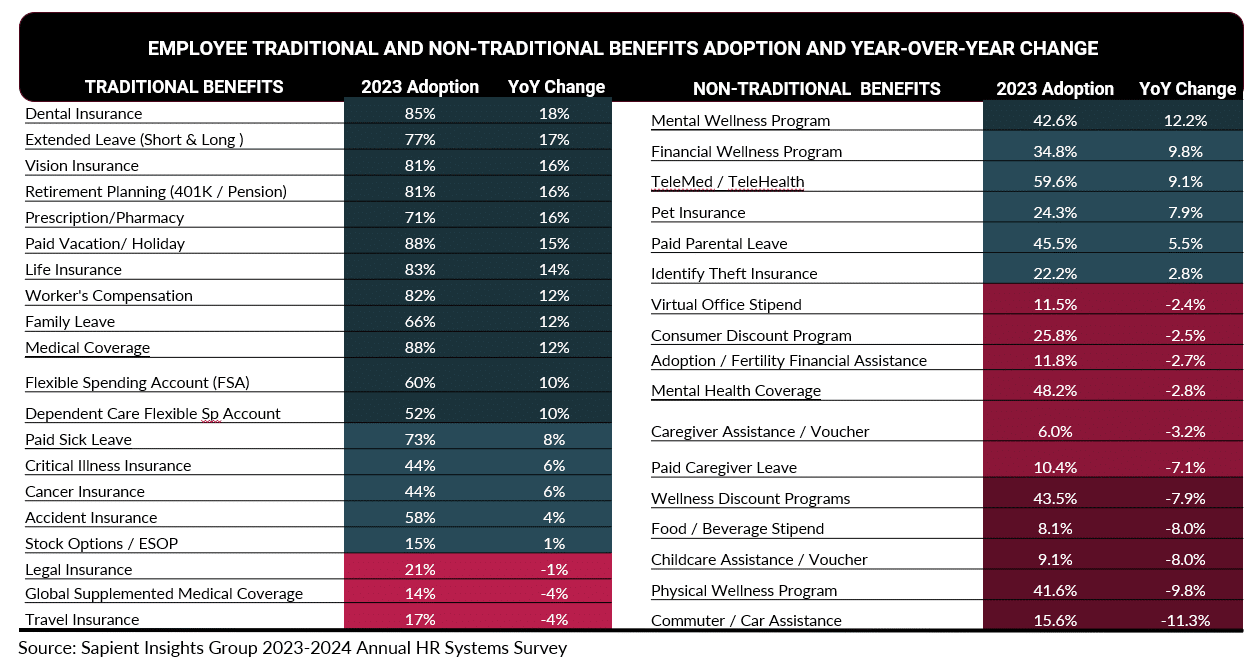

For instance, we saw year-over-year increases in the adoption of:

- dental insurance (18%)

- short- and long-term leave (17%)

- vision care (16%)

- 401Ks and pensions (16%)

- prescription coverage (16%)

- vacation time (15%).

In the less traditional benefits categories, we saw year-over-year increases in:

- mental health (12%)

- financial wellness (10%)

- programs and benefits targeting personalized needs such as telemedicine (9%), pet insurance (8%) and paid parental leave (6.5%).

Many of the offerings seeing the biggest decreases in spending were those introduced during the COVID pandemic, such as childcare assistance, physical wellness programs and commuting assistance.

How benefits are administered

Outsourcing benefits administration is still widely used by companies of all sizes. Overall, 55% of all companies either partially or fully outsource the administration of some benefit offerings. Services most frequently outsourced include retirement planning (70%), COBRA administration (69%), employee assistance programs (64%), voluntary benefits administration (57%) and spending account administration (47%). We do urge all companies using any kind of outsourcing service to be involved rather than hands-off partners. It’s critically important to manage outsourcing providers to ensure that work is being performed as promised, to review services on an ongoing basis and to make sure you’re getting the kind of reports and data needed to make positive changes for your employees and organization.

On a somewhat related note, our research also showed a 30% increase in the use of digital wellness platforms, such as Virgin Plus, Limeade (recently acquired by WebMD) or Wellable. Currently, 38% of companies use some kind of wellness platform, 5% have budgeted for a platform within the next 12 months, and another 5% have budgeted within the next 36 months. One reason for the uptick in use is that many benefit providers offer a platform along with their services; in fact, 22% of current users cite this as the business reason for use. Interestingly, 33% of users cite improved health behaviors as the primary business case for use.

Tying benefits strategies to the business

When businesses look to reduce expenses, cutting benefit offerings is often the knee-jerk reaction. However, doing so can undermine employee retention and productivity and hamper recruiting efforts—especially in times like these when most industry segments are seeing labor shortages.

We believe benefit offerings and how they are administered are more than “table stakes” for HR, and the people responsible for managing them shouldn’t be viewed as mere administrators.

We urge HR leaders to make sure that benefit offerings and associated policies are reviewed at least once a year to assess employee interest, utilization (broken down by demographics) and value to the business. If benefits aren’t being used, assess the accessibility of the offerings along with your employees’ trust for privacy.

The benefits team should proactively solicit employee feedback and suggestions, and critically, communicate to employees the details of benefit offerings and how to use them. When making important decisions about benefit changes, such as the recent push to closely manage the rising costs of GLP-1 drugs for the use of weight loss, be open and transparent with employees about the costs and their options.

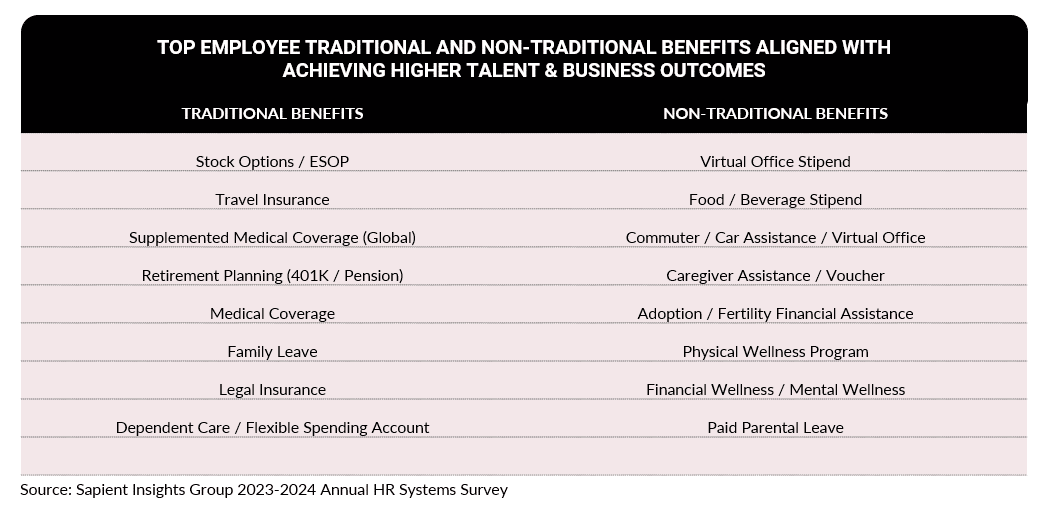

*Our research raised some interesting findings and related questions. For instance, it’s easy to understand why employee stock options have high correlation to employee satisfaction, competitive advantage and organizational innovation and profitability. However, we’re flummoxed to see an adoption increase of only 1% in this area. Travel and legal insurance also had similarly high correlations to these outcomes, but we don’t yet know why. Adoption and spending in both of these areas is decreasing.

Note: Sapient’s 2023-2024 HR Systems Survey will be live in May and June. In addition to collecting detailed data on system usage and solution providers, we also study HR staffing, programs, budgets and more. We urge you to sign up today. All participants will receive a copy of the results when the report is published later this year.

The post Want to boost employees’ perception of HR? Look at your benefits strategies appeared first on HR Executive.