Despite a potentially softening economy and purse-tightening on the part of employers, new data is suggesting investment in HR tech doesn’t seem to be slowing down. Data from WorkTech shows that global HR technology venture capital investment outperformed the rest of the market through the first half of 2022.

VC investment for H1 2022 puts the year on track to meet or exceed the $17.9 billion record set in 2021. The first half of this year already saw the second-largest global work tech investment, surging to $9.4 billion. With $4.6 billion invested in Q2 alone, it was the fourth-largest quarter on record.

Comparatively, Crunchbase reported that, overall, second-quarter funding was “the lowest amount recorded for a single quarter since the beginning of 2021 … ” and that “second-quarter funding fell 26% quarter over quarter.”

Related: 4 reasons global HR tech investment is surging

So, how can global HR tech funding surge while the rest of the market wanes?

To say that there’s uncertainty regarding the economy is an understatement. “Uncertainty” has already been tagged as the “word of the year” by The New York Times. But while inflation and interest rates are up, job growth only slowed slightly in June until it came roaring back in July with another 528,000 jobs added, keeping the U.S. labor market hovering around what economists call full employment.

Related: Why the recent job numbers reveal a looming crisis for HR

While economic conditions have stalled some tech markets’ accelerated trends and growth that COVID brought on, the factors that drove growth in HR technology have, so far, been unaffected by the softening economy. Many employers that reacted sharply to the early days of COVID with deep budget cuts and layoffs have struggled to bring back employment to pre-COVID levels based on the continuing strong job market. These may be mistakes the C-suite doesn’t want to make again.

HR and VC trends align

A deeper dive into the WorkTech data shows that Q2 investment aligns with the same trends we’re seeing expressed by HR leaders.

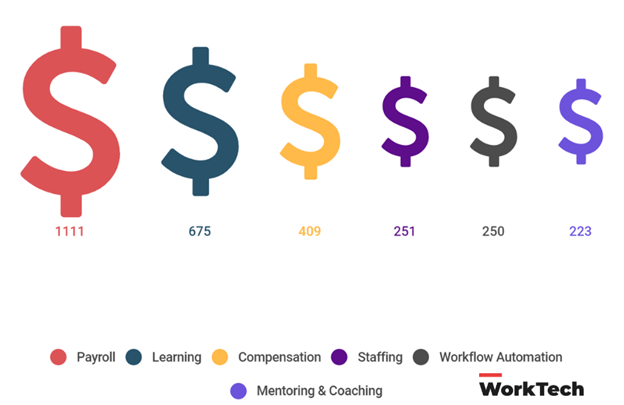

Payroll led the quarter with $1.1 billion in investment, driven by a surge in global payroll and “employer of record” (EOR) payroll solutions. EOR solutions like Velocity Global and Remote allow employers to hire full-time and contract employees without taking on the associated compliance risks or operational burden. The learning category also continued to attract substantial investment in Q2, at $675 million. However, the investments we’ve seen in learning during and post-COVID are in new “employee-first” models from providers like Guild that offer employees the opportunity to further their education across the spectrum, from skills certification to formal degrees with accredited and leading universities.

led the quarter with $1.1 billion in investment, driven by a surge in global payroll and “employer of record” (EOR) payroll solutions. EOR solutions like Velocity Global and Remote allow employers to hire full-time and contract employees without taking on the associated compliance risks or operational burden. The learning category also continued to attract substantial investment in Q2, at $675 million. However, the investments we’ve seen in learning during and post-COVID are in new “employee-first” models from providers like Guild that offer employees the opportunity to further their education across the spectrum, from skills certification to formal degrees with accredited and leading universities.

Related: How Macy’s, Guild hope to drive retention with upskilling effort

As wage growth continues to climb and employers struggle with pay equity, compensation solution providers like Pave provide new opportunities for comp strategy, and even more traditional compensations apps like Beqom attracted growth capital. Mentoring and coaching solutions have seen new interest from HR leaders looking to provide employees with tech that can contribute to upskilling, leadership development and employee mental wellness. This drove a surge in investment through 2021, which continued through Q2 with tech providers like CoachHub. In the world of talent acquisition, new models for finding and hiring talent continue to find buyers and investors as the job market remains hyper-competitive. New providers like Nomad Health, RippleMatch and Florence saw investors double down on continued growth in this category.

The future for emerging HR technology

While global HR technology investment has outperformed the rest of the market, if the economy does drift into a deep recession, there will be an impact on HR teams and the global HR tech market.

However, one reality seems to be here to stay: The emergence of the new work tech category promises systems and technology that are more inclusive of the entire organization, enabling collaboration across the whole enterprise and deep alignment between tech and modern work and leadership practices. This looks to be the next phase in the evolution of HR and HR technology, where business imperatives and people practices can align across a more modern digital experience. We’re keeping our eye on this space as we march toward 2023 and beyond.

Hear more from George LaRocque at the upcoming HR Technology Conference, Sept. 13-16 in Las Vegas, in his breakout session, “When Right Now Collides With What’s Next: How Forward-Thinking Leaders are Transforming the Recruiting Role.”

The post Why global HR tech VC investment is outperforming the market appeared first on HR Executive.